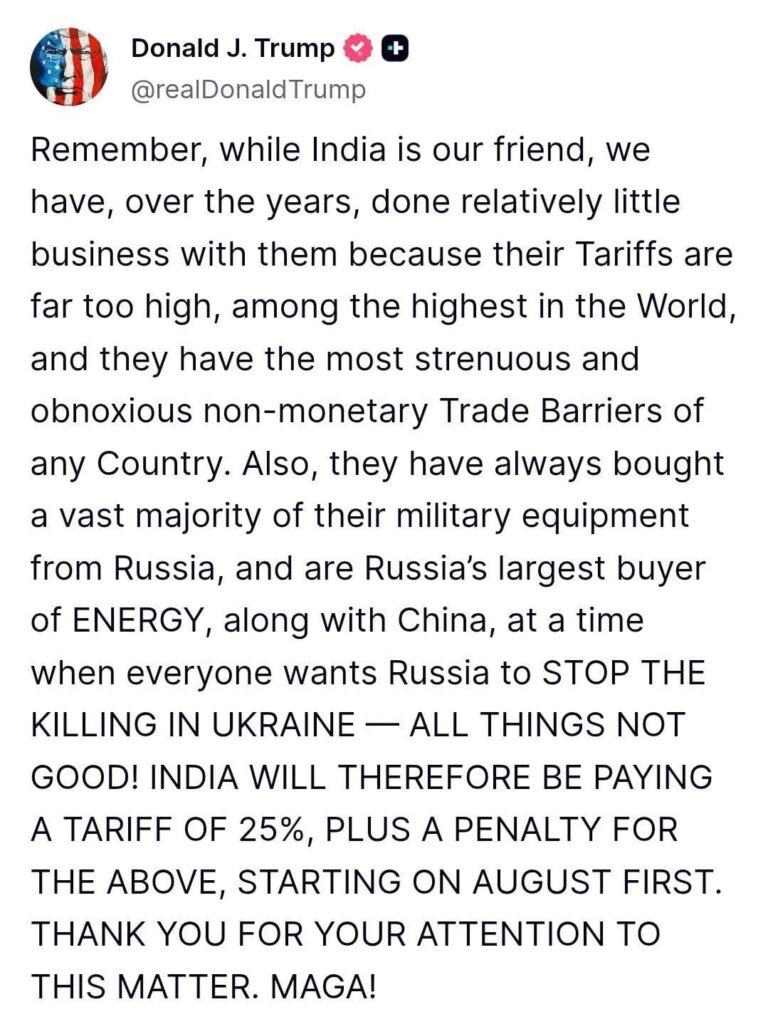

US 25% tariff on India: US President Donald Trump has announced a 25% tariff on imports from India. Read about what it means, how businesses and consumers in India will be affected, and expert reactions.

US 25% Tariff on India — What Happened and Why It Matters

Date: July 30, 2025

Source: Indian Tech & Infra’s official X.com post

In a surprising move, US President Donald Trump has announced a sweeping 25% tariff on goods imported from India, effective immediately. This decision signals a major shift in trade between the two nations and raises serious questions about its impact on businesses, consumers, and the Indian economy.

Why Did the US Impose a 25% Tariff on India?

Rising trade deficit

One of the key reasons behind this decision is the growing trade imbalance. The US aims to protect domestic industries like steel, textiles, and pharmaceuticals that face competition from imports.

Political strategy

Trade tariffs often serve as strategy in political negotiations. This move may be aimed at pressuring India to agree to trade terms more favorable to the US in upcoming talks.

Also Read – Asaduddin Owaisi: Voice Of Dalit, Minorities & Adivasi

Support for American industries

By imposing tariffs, the US government intends to boost jobs and production in its own factories, especially in sectors where competition from Indian imports has been strong.

What Is Included Under the 25% Tariff?

Affected goods include: textiles, pharmaceuticals, auto parts, agricultural produce, jewellery, and certain electronics.

Imports excluded: some essential items like medical supplies and renewable energy equipment may be exempt, depending on future clarification from the US administration.

Impact on Indian Businesses & Exporters

Exporters Face Higher Costs

Indian exporters in key sectors like textiles and pharma will now incur higher costs to sell in the US. This could reduce demand and profit margins.

Ripple Effect on Small Businesses

Smaller manufacturers who depend on US orders may suffer loss of contracts or reduced volumes. They might also struggle with lower competitiveness.

Negotiation Pressure

Businesses and trade bodies will likely lobby the government for support, subsidies, or negotiation of exemptions to reduce economic pain.

How Will Indian Consumers Feel This Tariff?

Higher Prices on US Goods

Consumers in India may see increased prices for imported goods from the US, including electronics and specialty items.

Limited Choice

With higher tariffs, availability of some US-branded products in Indian stores or online platforms might reduce.

Indirect Impact

Costlier outgoing supplies from India to the US could result in lost jobs at home, affecting income levels and local purchasing power.

Experts Views On Tariff

Economists and trade analysts have responded with concern:

Export Council Warnings: Indian trade bodies warn that this tariff may cost export firms billions in lost revenue.

Consumer Sentiment: Analysts expect a “trickle‑down” effect — higher prices, slower growth, and reduced competitiveness abroad.

Government Response: The Indian government is reportedly evaluating countermeasures, including exploring WTO complaint routes or imposing reciprocal tariffs.

Timeline & Implementation

Effective Date: The tariff on imports takes effect from July 30, 2025.

Duration: It may be temporary until trade negotiations resolve tensions—or longer if disputes deepen.

Periodic Reviews: White House officials may reevaluate annually, depending on trade outcomes and political developments.

How India Might Respond

Retaliatory Tariffs

India may choose to levy similar tariffs on US goods, triggering a trade standoff with both sides bearing economic pain.

Diplomatic Dialogues

Officials from commerce and foreign ministries are expected to engage with US counterparts to seek exemptions or soften the impact.

WTO Dispute

India could file a complaint at the World Trade Organization claiming unfair trade practices if negotiations fail.

Business Adaptation

Indian exporters might explore new markets (EU, Middle East, Africa) or diversify products to reduce dependence on the US.

FAQs: US 25% tariff on India

Q: What is the new US tariff on Indian goods?

A: A 25% tariff on a wide range of imports from India, announced on July 30, 2025, targeting textile, pharma, auto, agri and more.

Q: Which Indian products will face the highest impact?

A: Textiles, garments, pharmaceuticals, jewellery, agricultural produce and auto components are expected to be hit hardest.

Q: Will this tariff apply to medical or critical goods?

A: The US might exclude certain essential or strategic items, but specific guidelines are still pending.

Q: What can Indian exporters do now?

A: They can lobby government support, diversify into new markets, adjust product pricing, or raise exports through free‑trade agreements.

Q: Could India challenge the tariff at the WTO?

A: Yes, if talks fail, India may file a formal dispute claiming violation of global trade rules.

Final Thoughts — What Lies Ahead?

US 25% tariff on India: This 25% tariff is a bold and abrupt trade decision. It could reshape India–US trade landscape, pushing Indian businesses to rethink strategies and diversify markets. For consumers, expect subtle price rises on US goods and changes in availability.

Nevertheless, India has options: negotiating exemptions, exploring global markets, or even retaliating. The coming months will be critical—negotiations and diplomatic talks will define whether this results in short-term pain or long-term restructuring. Indian businesses and citizens should stay alert.

[…] Also Read – US 25% Tariff On India. […]

[…] Also read – US 25% Tariff On India. […]