How the simple 12×12×20 SIP formula—invest ₹12,000 monthly at 12% for 20 years—can build over ₹1 crore. Learn step-by-step, and tips for smart investing.

Imagine a life where you don’t need to clock office hours to afford the things you love. Sounds dreamy? But that dream can unfold real—with a smart, simple strategy known as the 12×12×20 SIP formula. The idea is powerful: invest ₹12,000 each month, earn around 12% annually, and stay invested for 20 years. The result? A corpus of over ₹1 crore.

What Is the 12×12×20 SIP Formula—and Why It Works?

This formula is easy to remember:

₹12,000 per month.

12% annual return (an average, not guaranteed)..

20 years of investing.

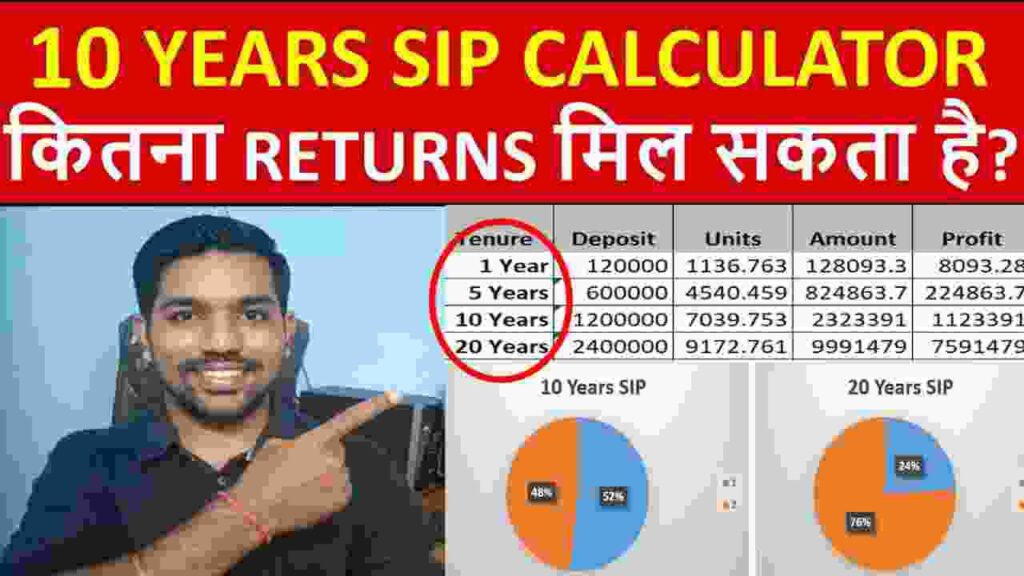

Here’s what happens: over 20 years, ₹12,000 × 12 = ₹1,44,000 invested each year, totaling ₹28.8 lakh over 20 years. With compounding at 12%, this builds up to about ₹1.10 crore. That’s how ordinary savings can bloom into extraordinary wealth.

Why it works:

Small, steady steps: You invest a fixed amount every month—easy on the pocket.

Compounding magic: Your returns earn returns, like snowballing wealth.

Also Read – NPS Scheme Security Policy.

Rupee-cost averaging: You buy more when prices dip, less when high—smoothing out highs and lows.

Benefits That Make the 12×12×20 Formula Click

- Discipline made easy

Investing ₹12k monthly is doable with proper budgeting. Streaks matter! - Stress-free approach

No need to time the market. You just stay on track and let compounding do its magic. - Measurable goal

In just 20 years, you have a clear target—over ₹1 crore, not wishful thinking. - Planning freedom

Whether it’s early retirement, a dream home, or world travel—the options open up.

How to Get Started—Your Step-by-Step Plan

Open a mutual fund SIP

Pick a fund known for consistent 10–12% returns—like large-cap or good balanced funds.

Automate your investment

Simply set up an automatic monthly debit of ₹12,000. No excuses.

Review yearly, not daily

A quick check-in once a year is enough—avoid daily stress over market swings.

Avoid panic reactions

Markets dip, they rise. Stick to your timeline even when the news is loud.

Top-up when you can

As salary grows, consider adding more—supercharges the final amount.

Is 12% Return Even Realistic?

Yes—with caution. Many equity or balanced funds in India have returned 10–12% over long periods. Past performance isn’t guaranteed, but it’s a healthy benchmark. The key is long-term discipline over short-term chasing.

For example:

Outlook Money highlights SIP’s power in long-term investing—growing wealth with consistency and compounding.

Motilal Oswal explains how SIP calculators compute this projected future value using formulas.

FAQs:

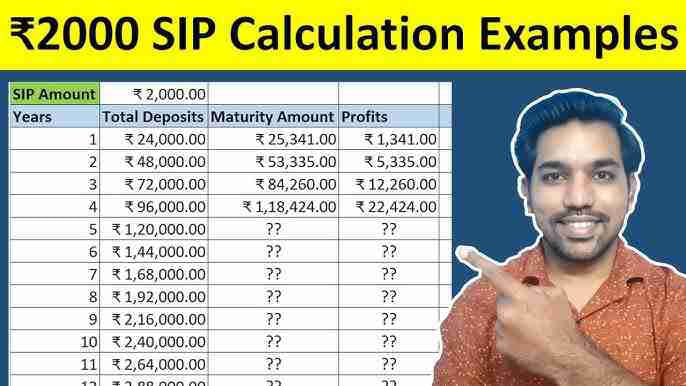

Q1: Can I invest less than ₹12,000?

See the power of SIP flexibility—yes. Just know your final target will take longer or be lower. The magic comes from amount × return × tenure.

Q2: What if returns are only 10%?

Your corpus will be lower, but still solid. You can either invest more monthly or extend the years.

Q3: Should I stop after 20 years?

You can continue. Let compounding carry you further—or withdraw gradually depending on your goals.

Q4: Are SIP calculators reliable?

They give estimates based on formula:

FV = P \times \left(\frac{(1+i)^n – 1}{i}\right) \times (1+i)

Q5: What if my fund underperforms?

Diversify across 2–3 well-performing funds. Review annually and switch if needed (avoid frequent changes).

Use power words like unlock, discover, simple, discipline, confidence, bloom to connect emotionally.

Transitions to keep the flow: start paragraphs with words like Imagine, Here’s how, So, That’s why, In short.

In a Nutshell

What: Invest ₹12,000 per month via SIP, earn ~12%, over 20 years.

Why: To build ₹1 crore in retirement corpus, big goal without big pressure.

How: Start early, automate, review annually, stay disciplined, and let compounding work.

Final Thoughts

Look, I get it—talk of financial plans can sound heavy. But here, it’s simple: invest a small amount regularly, trust the process, and time will reward you. The 12×12×20 SIP formula isn’t magic—it’s just common sense, powered by discipline and consistency.

Start your SIP today, stick with it, and watch your efforts flourish. Your future self will thank you—like seriously, with a big, grateful smile.

[…] Also Read – Unlock Financial Freedom. […]