Why the PPFAS Flexi Cap Fund has crossed ₹1 lakh crore AUM, its performance, strategy, and whether it fits your portfolio in 2025.

Is PPFAS Flexi Cap Fund a Smart Choice for Your Portfolio in 2025?

You must have seen InvestyWise asking: “Is PPFAS Flexi Cap Fund part of your mutual fund portfolio?” That’s a great question—so here’s a full deep‑dive. No fluff, just honest, easy Hindi‑English style chat.

Why Everyone Talks About PPFAS Flexi Cap Fund

First up—this fund has become huge. In May 2025, it crossed a massive ₹1 lakh crore AUM, making it the largest flexi‑cap fund in India. Neil Parikh, the CEO of PPFAS, confirmed this milestone.

That kind of growth signals trust and consistency. It means many investors are piling in—and that means you should understand what’s going on.

Also Read – President Of India Stock Holding.

What Makes It Stand Out? Performance & Strategy

Returns You’ll Appreciate!

Since May 2013, the fund has delivered an average annual return of about 19.9 %.

Its 1‑year return (as of July 2025) sits around 9 %, which beats most peers.

And 3‑year returns hover near 22–23 %, while 5‑year returns are about 24–25 %.

So if your goal is long‑term growth, this fund has delivered. It’s all about staying invested through ups and downs.

Value‑Driven, Active Strategy

PPFAS follows a value investing style. They invest in Indian and foreign equities that seem undervalued, and they hold them with patience. Their threat: if they don’t see value, even when markets rise—they step careful.

They also keep equity exposure around 80 %, sometimes more, and occasionally up to 97 %, depending on opportunities. That’s a sign of confidence in equity markets, particularly when valuations look attractive.

Risk Controls & Stability

Expense ratio is modest at 0.63 %, which is about average in this category.

Volatility is lower than many peers—standard deviation around 9 % and beta around 0.58, meaning it moves less wildly with the broader market.

Risk‑adjusted measures like Sharpe ratio (~1.9) show strong returns for the risk taken.

In short, it’s very high risk (typical for equity funds), but managed with discipline and diversification.

Can It Handle ₹1 Lakh Crore AUM?

Many people wonder: As the biggest flexi‑cap fund, can it still perform?

Neil Parikh addressed this in July 2025, explaining that SEBI treats limits at the entire AMC level, not just per scheme. So adding more money doesn’t mean stock concentration issues—they manage it carefully across all schemes.

So yes, they say they can handle scale without hurting performance.

Surge in Investing—AUM & Strategy Shifts

In June 2025, mutual funds across India reduced their cash holdings by over ₹13,000 crore, bringing total cash to ₹2.04 lakh crore. PPFAS joined this move—indicating they are deploying more funds into equities rather than holding idle cash.

This aligns with a bullish optimism: deploy cash when valuations and timing look right.

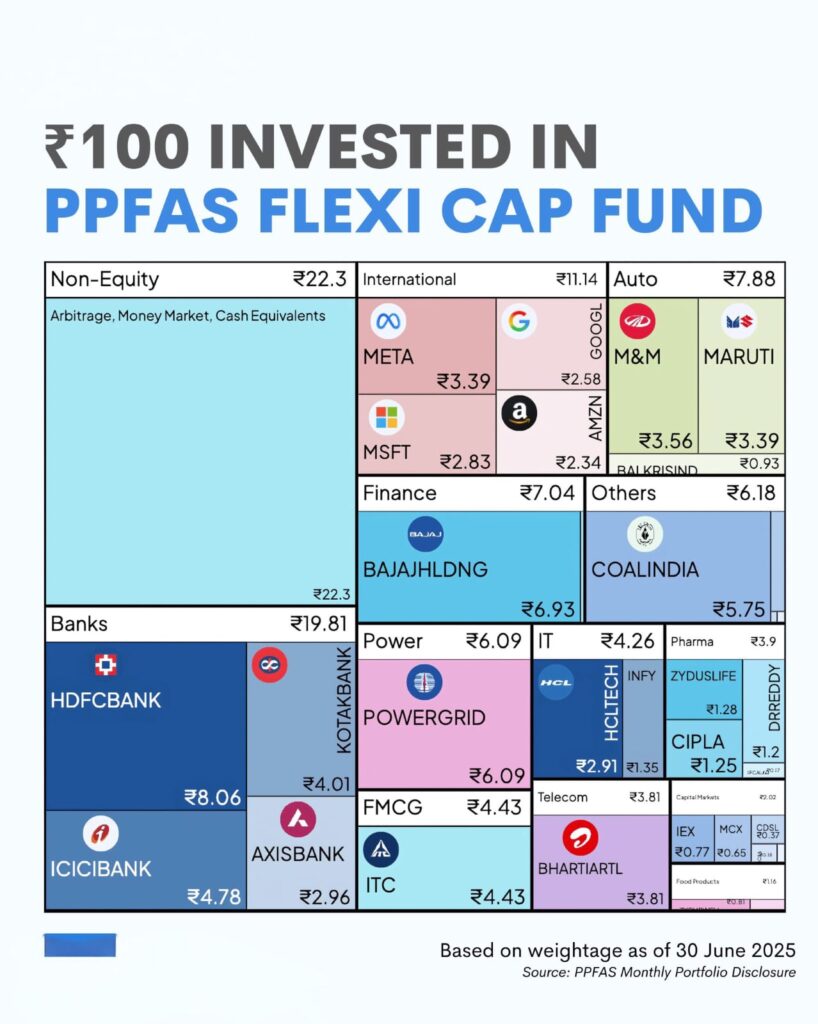

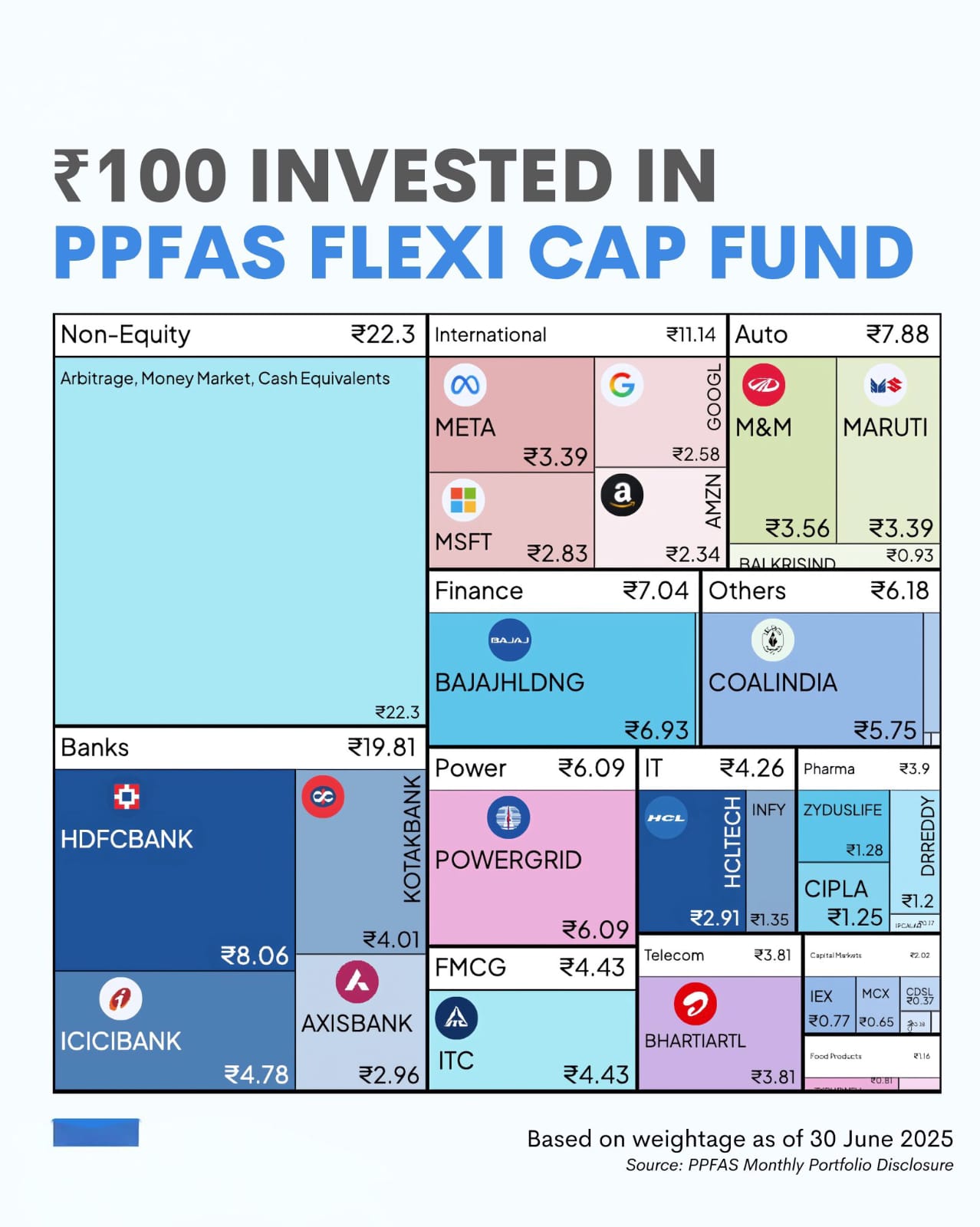

Top Holdings & Sector Mix

Here’s a plain list of where your money would go:

- HDFC Bank (~8 %)

- Bajaj Holdings (~6.9 %)

- Power Grid (~6 %)

- Coal India (~5.8 %)

ICICI Bank, ITC, Kotak Bank etc. round off the top 10.

Sector‑wise:

Financials ~27–28 %

Services, Automobile, Tech, Energy, Consumer Staples, etc. diversification across industries.

They also hold a bit of foreign equity (up to ~10–11 %) and some debt money market for liquidity.

Should You Add It to Your Portfolio?

Pros:

Proven long‑term track record (~20 % annual returns).

Large AUM shows investor trust.

Moderate fees.

Value bias, global exposure, and balanced sector mix.

Disciplined risk management.

Things to think about:

It’s very high risk—not for those who can’t stomach volatility.

Exit load: 2 % if redeemed within 1 year (beyond 10 % units), 1 % within 2 years → so use for SIP or long horizon.

If you’re already heavy in banking/financials, your portfolio may mirror the fund—watch overlap.

FAQs:

Q1. What is PPFAS Flexi Cap Fund NAV?

NAV (direct plan) as of 28 July 2025: ₹91.58; regular plan: ₹84.02.

Q2. What are its Categories and risk level?

Equity Flexi Cap fund; very high risk. Buy only if you’re comfortable with market swings.

Q3. What is the minimum SIP or lump-sum amount?

Start from ₹1,000 per SIP or lump-sum, easy entry point.

Q4. What is the exit load?

No exit load on first 10 % of units. Then 2 % within 1 year, and 1 % if redeemed within 2 years.

Q5. Is foreign equity part of the fund?

Yes, up to 30–35 % limit. Currently about 10–11 % actually invested in global equities.

Final Thoughts – Why It’s Gaining So Much Love

Honestly, the mix of steady past returns, value investing discipline, and flexi‑cap agility makes this fund attractive for many long‑term investors. The news of crossing ₹1 lakh crore AUM shows popularity, but what really matters is the strategy—finding value, staying diversified, and managing risk.

If you’re someone who invests with a 5+ year goal, SIP regularly, and stays calm during market drops, PPFAS Flexi Cap Fund deserves serious attention.

Closing Note

So, is the PPFAS Flexi Cap Fund part of your portfolio? If you’re looking for steady growth and you can ride the ups and downs, it just might be a smart pick. But like any fund, only invest what you’re comfortable holding for years—not weeks.

Summary

| Question | Answer |

| What is the NAV of PPFAS Flexi Cap Fund? | ₹91.58 (Direct) / ₹84.02 (Regular) as of 28 July 2025 |

| What are the returns? | ~9 % in last year; ~22‑23 % over 3 years; ~19‑20 % since inception |

| What’s the fund size (AUM)? | ₹1,10,392 crore as of 30 June 2025 |

| What is the expense ratio? | 0.63 % |

| Any exit load? | 2 % within 1 year (beyond 10 %), 1 % within 2 years |

| Is there foreign equity exposure? | Yes, around 10‑11 % actual current holdings |

[…] Also Read – PPFAS FlexiCap Fund a Smart Choice. […]