Why NSE unlisted shares are rallying 115%, how retail investors can ride the wave, risks vs rewards, IPO timeline & smart tips for investing wisely.

Why “NSE unlisted shares” Are in Every Investor’s Chat Right Now

In the last 12 months, NSE unlisted shares have rocketed over 115%, rising from roughly ₹1,100 to ₹2,370 in grey‑market trades. That’s no small jump—this frenzy comes as India waits for the exchange’s IPO, expected in Q4 FY26 (likely by March 2026). What’s driving this?

What’s Fueling This Price Rally?

- Looting Value Before IPO

Investors want early access to what could be India’s biggest-ever IPO. NSE is commanding grey‑market valuations of ₹2,300–₹2,389 per share, suggesting a whopping ₹5.9 lakh crore market cap.

Also Read – From 40K to 800 Crore From Small Baseball Card Investment.

- Retail FOMO & Growing Participation

The number of retail investors soared from ~16,000 to ~34,000 in one quarter, pushing their stake from ~8% to nearly 10%. Over 1 lakh retail shareholders now back NSE—the highest ever in India’s grey market. When everyday people jump in, sentiment turns electric.

- Powerful Fundamentals & Cash‑Rich Model

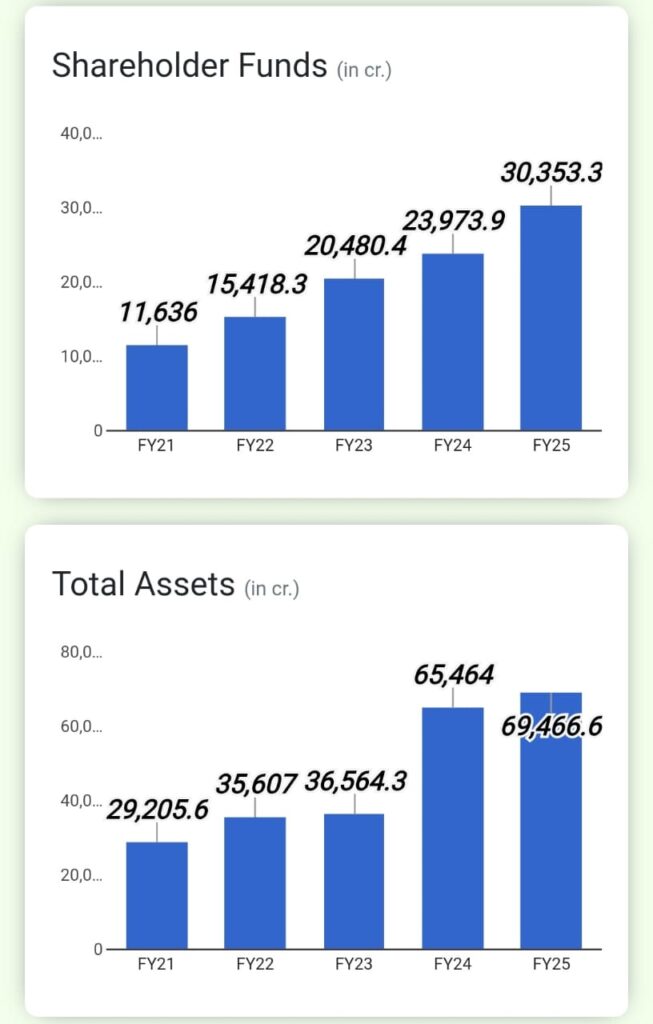

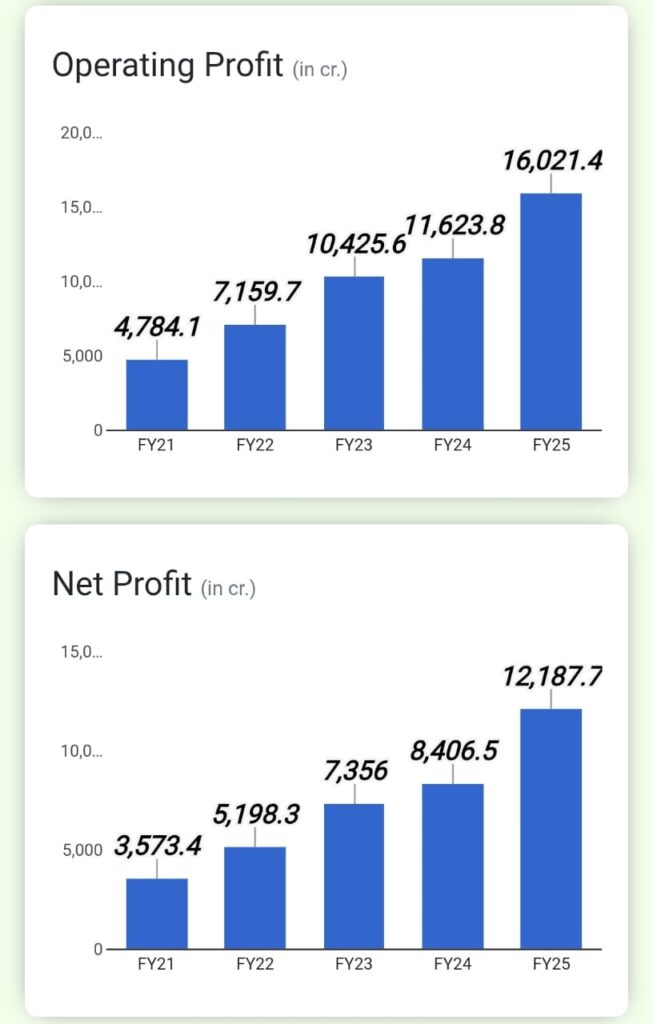

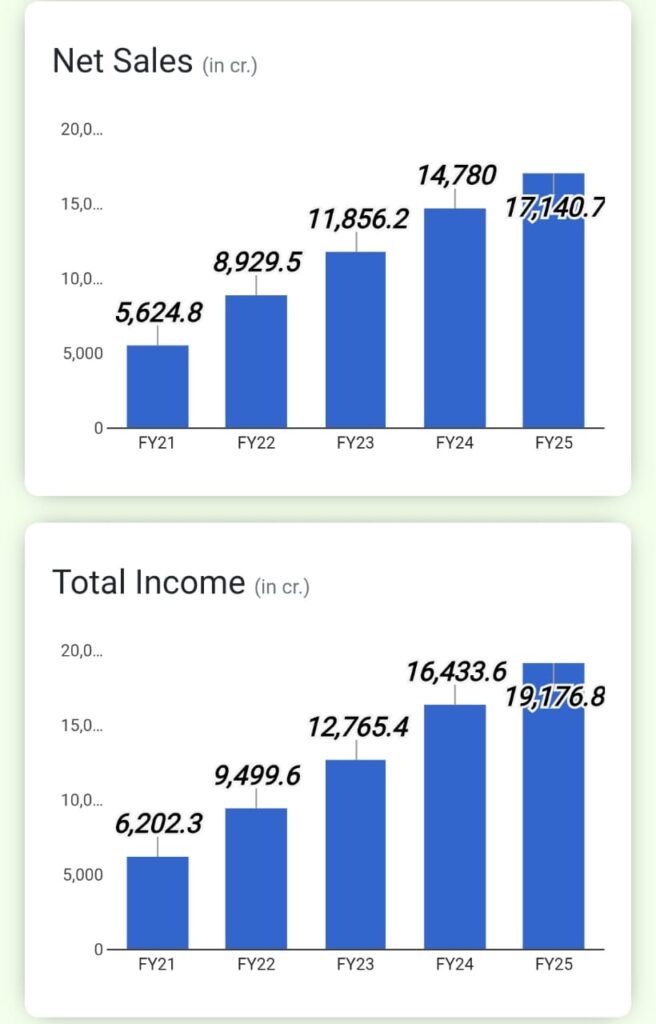

In FY 2025, NSE posted a 16% jump in operating revenue to ₹17,141 crore and a 47% jump in PAT to ₹12,188 crore. Margins are stellar—EBITDA at ~74%, PAT at ~58%.

- Undervalued Compared to BSE

NSE trades at only ~46–46x P/E in private markets versus BSE at ~74–80x P/E. For investors, that’s a bargain for a dominant player.

- IPO Nearing Reality

NSE has reportedly offered to settle ₹1,388 crore with SEBI over past market access issues—possibly clearing the way for a “no‑objection certificate” within 3 months and IPO before May next year. Motilal Oswal and other experts expect that the IPO may happen in Q4 FY26.

What the Buzz Means for Your Portfolio

Early access to a monster IPO: Shares could climb even more when NSE finally lists.

Diversification edge: Unlisted shares don’t follow daily stock market swings.

Liquidity may surprise you: If demand continues, grey‑market liquidity improves—yet beware of sudden freezes.

Bye‑bye value gap: As IPO approaches, the pricing advantage vs BSE may narrow, tapering gains.

Know the risks:

No guarantee of IPO success: Delays may happen—SEBI could still block listing.

Grey market = less oversight: No formal exchange rules—liquidity and fairness issues abound.

Premium could crash: Nithin Kamath of Zerodha warns: “Risks are far greater than most investors realise”.

Valuation volatility: Pre‑IPO stocks like HDB Financial fell post listing, despite huge grey premiums.

How to Buy NSE Unlisted Shares (Simple Steps)

- Choose a trusted broker/platform (like SharesCart or UnlistedZone).

- Complete KYC + paper‑work: PAN, Aadhar, CML, broker verification.

- NSE approval: Broker files a form, gets board clearance in ~1–1.5 months.

- Execute share transfer via DIS slips next month. Entire process ~3 months.

- Pay extras wisely: Brokerage, stamp duty, documentation costs (₹5k–₹10k).

FAQs:

Q: What exactly are unlisted shares?

A: Shares not on an official exchange but traded privately via OTC markets – often in a “grey market”.

Q: Is it legal to invest in them?

A: Yes, legal—but riskier. Use registered brokers, check SEBI rules, complete KYC/AML.

Q: Are they taxed differently?

A: Long‑term capital gains over 2 years taxed at 12.5% (flat), post Budget 2024. No indexation benefit.

Q: When is the IPO likely coming?

A: Likely in March 2026, per Motilal Oswal & Business Standard.

Q: What if the IPO gets delayed further?

A: That could stall liquidity and dampen prices upside. Investors are betting on timelines.

Q: How many retail investors are on board?

A: More than 1 lakh, breaking all grey‑market records.

Q: How much is NSE unlisted share price today?

A: ~₹2,300–2,389 range in grey‑market trades by early July 2025.

Q: Can retail investors buy NSE unlisted shares?

A: Yes. Retail participation doubled recently, now over 1 lakh shareholders.

Q: When will NSE go public?

A: Projected IPO by Q4 FY26, possibly March 2026, after SEBI settles old cases.

Q: What are risks in grey market shares?

A: Risks include illiquidity, undervalued redemptions, regulatory delays, price choppiness.

Q: How to invest in NSE pre‑IPO shares?

A: Via KYC-verified broker, NSE board approval, DIS slips—takes ~3 months.

Tips Before You Invest

- Don’t go all-in: Keep exposure limited—maybe 5–10% of your equity portfolio.

- Follow SEC/SEBI outcomes: A green light or delay could shift trends drastically.

- Track financials: Focus on NSE’s margins, revenue, regulatory news and P/E.

- Pick reputed brokers: Check transparency, slip process, dispute history.

Final Word: Ready or Not?

The NSE unlisted share story is a thrilling ride. High growth, solid profits, and IPO hopes make it alluring. But without formal listing yet, grey‑market conditions bring real uncertainty—liquidity, timelines, regulatory issues remain open.

If you’re thinking early—balance potential gains with caution, stay informed, and invest smartly. It’s one of India’s most talked‑about pre‑IPO plays, and it could change your portfolio outlook—if you tread wisely.

[…] Also Read – NSE Unlisted Shares Surge. […]