With just Deposit ₹500 per month, parents can build a huge fund for their daughter’s future. Know the scheme details, benefits, eligibility, and how to invest smartly.

Introduction

In today’s time, every parent wants to secure their child’s future, especially daughters. Rising education costs, marriage expenses, and the need for financial independence make it important to start saving early.

The good news is that with just ₹500 per month, you can build a fund worth lakhs for your daughter. This is possible through government-backed small savings schemes that offer guaranteed returns with safety. One such scheme is the Sukanya Samriddhi Yojana (SSY), which is specially designed for the girl child.

What is Sukanya Samriddhi Yojana?

The Sukanya Samriddhi Yojana (SSY) is a savings scheme launched by the Government of India under the Beti Bachao Beti Padhao campaign. It is aimed at promoting the financial security of daughters in every family.

- Minimum deposit: ₹250 per year.

- Maximum deposit: ₹1.5 lakh per year.

- Tenure: 21 years or till marriage of girl (after 18 years).

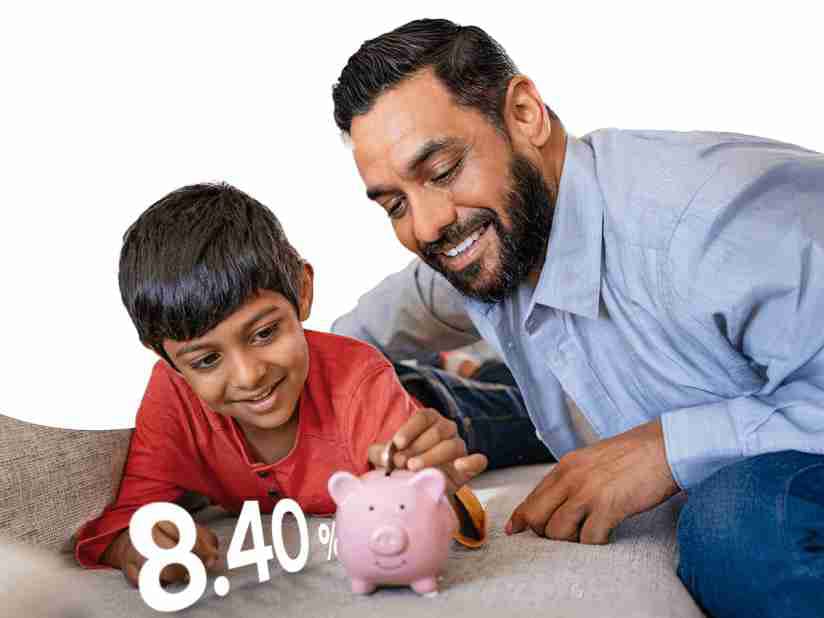

- Interest rate: Currently 8.2% per annum (compounded annually).

- Tax benefits: Section 80C deduction up to ₹1.5 lakh.

How ₹500 Per Month Becomes Lakhs?

Parents often think that small savings won’t help, but due to compounding interest, even ₹500 per month can create a large amount.

Example calculation:

- Monthly deposit = ₹500

- Yearly deposit = ₹6,000

- Duration = 15 years (deposit period)

- Interest rate = 8.2% per annum (as per current rate)

At maturity (21 years), the fund will grow to around ₹2,50,000+.

If parents increase the amount (say ₹1,000 per month), the fund can go up to ₹5 lakhs or more.

This shows the power of small but consistent savings.

Key Benefits of Investing in SSY?

Safe and Secure

Since it is a government-backed scheme, the investment is completely safe.

High Interest Rate

SSY offers one of the highest interest rates among small savings schemes.

Tax-Free Returns

Both deposits and maturity amount are tax-free, making it highly beneficial.

Flexibility in Deposits

You can start with as low as ₹250 per year and increase as per your capacity.

Also Read – Festival Season Sale Safety.

Girl Child Empowerment

It ensures financial independence for your daughter when she turns 18 or marries.

Eligibility and Rules

The scheme is only for girl children below 10 years.

Parents/guardians can open the account in the name of the daughter.

A family can open a maximum of 2 accounts (for two daughters).

If twins are born, then 3 accounts are allowed.

An account can be opened in any post office or authorized bank.

How to Open a Sukanya Samriddhi Yojana Account?

- Visit your nearest bank or post office.

- Fill the SSY account opening form.

- Submit birth certificate of daughter.

- Provide identity and address proof of parents.

- Deposit the minimum amount of ₹250 (or ₹500 as planned).

Once the account is active, you can keep depositing monthly or yearly.

Why Parents Should Start Early?

Starting early gives more time for money to grow. If you open the account when your daughter is just 2 years old, by the time she is 21, the fund will be big enough to cover:

- Higher education fees.

- Marriage expenses.

- Setting up her career or business.

Even if you can invest only ₹500 per month, the returns are solid and guaranteed.

Other Similar Schemes to Consider

Apart from Sukanya Samriddhi Yojana, parents can also explore:

Public Provident Fund (PPF) – Long-term savings with tax-free returns.

Recurring Deposit (RD) – Fixed monthly savings with assured returns.

LIC Kanyadan Policy – Special insurance plan for daughters.

But among all, SSY remains the best because of its high interest and government security.

Expert Advice

Financial experts always recommend starting small but staying consistent. Parents should not wait until they have big savings. Even ₹500 today is better than ₹0 tomorrow.

Also, try to increase the contribution every year as your income grows. This will multiply the returns and create a bigger fund.

FAQs:

Q1. Can I invest more than ₹500 in Sukanya Samriddhi Yojana?

Yes, you can deposit up to ₹1.5 lakh per year. ₹500 is just the minimum monthly example.

Q2. What happens if I skip a year?

You can revive the account by paying a penalty of ₹50 per year along with the minimum deposit.

Q3. Is the maturity amount taxable?

No, both interest earned and maturity amount are completely tax-free.

Q4. Can I withdraw before 21 years?

Yes, partial withdrawal (up to 50%) is allowed after the girl turns 18 years for higher education.

Q5. Where can I open the account?

You can open it in any post office or authorized public/private bank.

Conclusion

Saving for your daughter’s future doesn’t always need a big amount. With schemes like Sukanya Samriddhi Yojana, even a small deposit of ₹500 per month can turn into lakhs over time.

It is safe, guaranteed, and tax-free – making it one of the best investments for parents in India.

So, if you haven’t started yet, visit your nearest bank or post office today and open the account. A small step now can secure a big future for your daughter.

[…] Also Read – Deposit 500 per month for your daughter. […]