7 July 2025 Why BSE Ltd share price plunged nearly 7%, how SEBI’s action against Jane Street impacts the market, expert insights, future outlook.

What happened with BSE Ltd and Jane Street?

On July 3, 2025, the Securities and Exchange Board of India (SEBI) issued an interim order barring Jane Street, a big US quant trading firm, from trading in India. This is because SEBI suspects manipulation in index derivatives like Nifty and Bank Nifty.

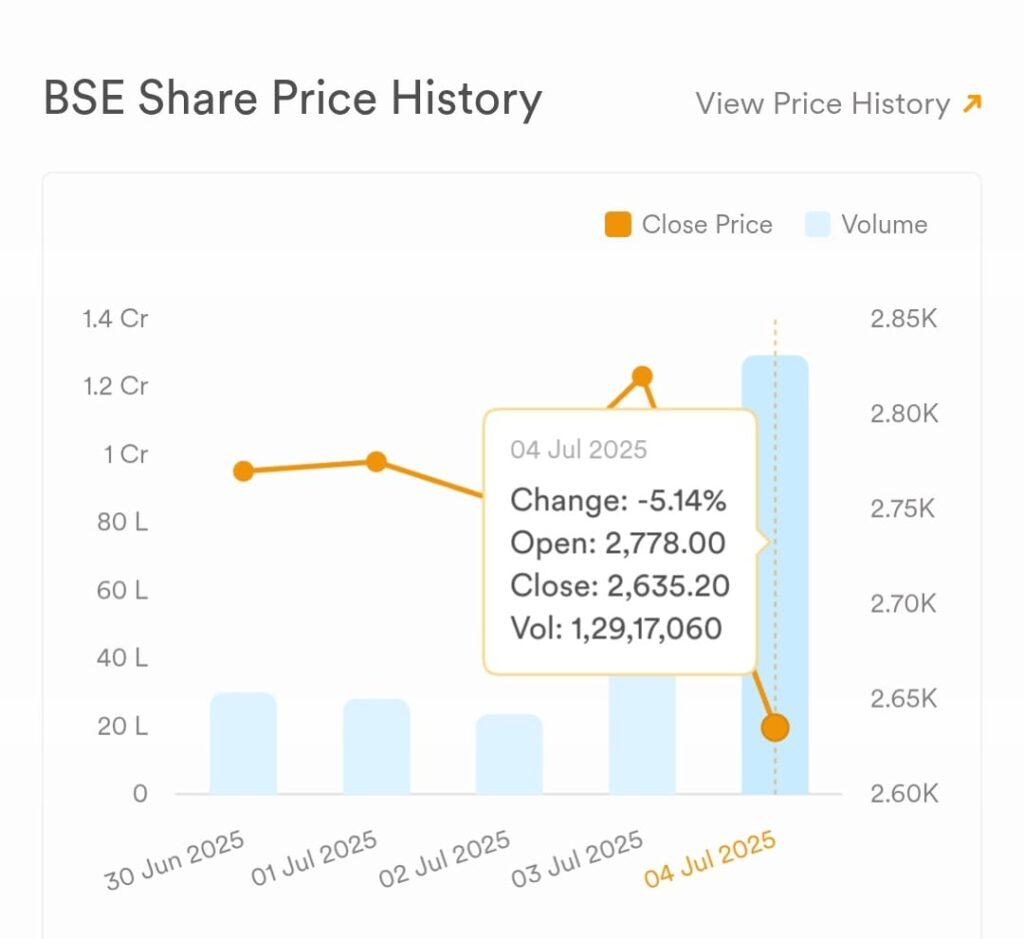

As soon as the news broke, shares of BSE Ltd (BSEL.NS) plummeted by around 6.5–7%, slipping from ~₹2,820 to ~₹2,635 on July 4–6, 2025. Intraday lows even hit ₹2,613.

Why did the stock fall so sharply?

- Derivatives Volumes Fear:

Jane Street was a big player. If it’s barred, SEBI action could reduce derivatives turnover—hurting BSE’s revenues from F&O trades. - Market Jitters:

Investors worry SEBI’s crackdown might freeze algorithmic players or delay new ones. Immediate effect? Volatility and risk-off sentiment. - Technical Pressure:

Analysts highlight that BSE’s strong rally had triggered some profit‑booking. Resistance at ₹2,778 & support around ₹2,648–2,500 are in play.

Numbers at BSE Ltd share price

| Metric | Value |

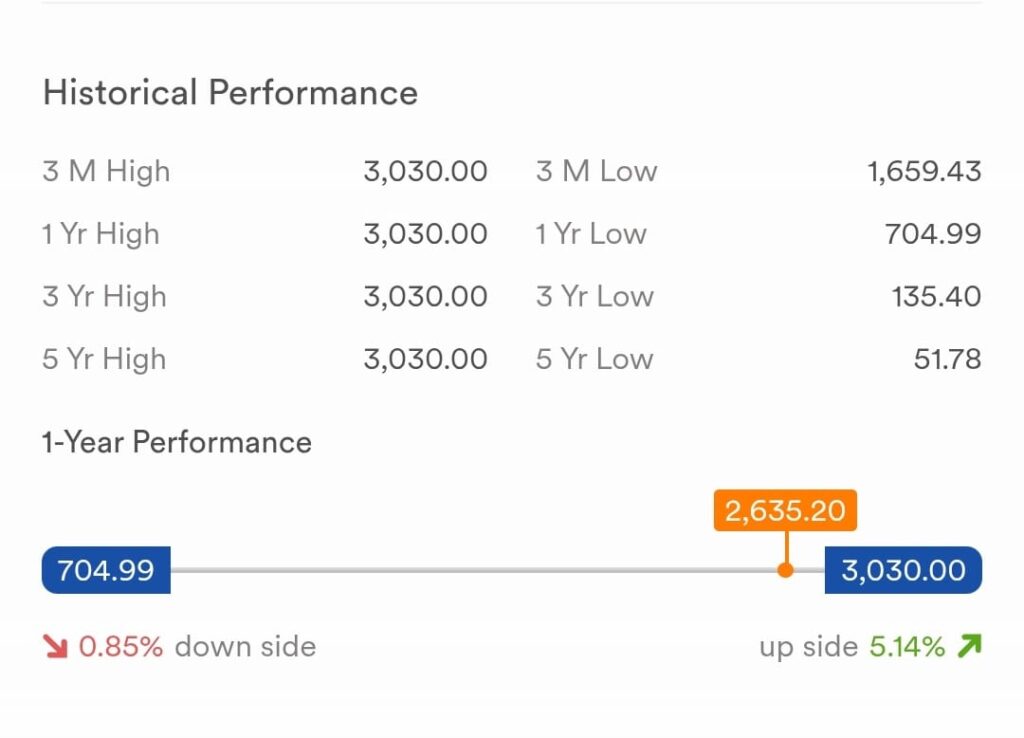

| Latest Price | ~₹2,635 |

| Change | –6.56% |

| Market Cap | ₹1,07,000 Cr |

| 52‑Week Range | ₹705 – ₹3,030 |

- Source: LiveMint, Reuters, Trendlyne.

SEBI’s Bold Move—Good or Bad?

Short‑term hit: Definitely. Trading volumes might dip temporarily across the derivatives market.

Long‑term gain: SEBI is tightening rules—making markets cleaner and boosting investor trust. Experts say this may encourage more sustainable participation.

Global alignment: India now mirrors mature markets (like the US) in sanctioning bad actors quickly—this is a win for transparency and regulatory strength.

Also Read – NSE Unlisted Shares Surge.

BSE’s Strengths & Challenges

Strengths:

- Asia’s oldest stock exchange (founded 1875), with over 5,600 listed companies—Sensex being world-famous.

- Declared almost debt-free, with strong income from listings, data, tech services—65+ tnc 5‑year profit CAGR.

- Diversified across equities, currencies, debt, mutual funds, and derivatives.

Challenges:

- Overvalued entry (P/E ~80; P/B ~24 vs industry averages).

- Heavy dependence on F&O turnover—sensitive to regulatory storms.

- Previous tech issues and unfair access controversies—trust can fracture.

Outlook: What Experts Say

“Short‑term correction likely” per technical analysts, with key support zones at ₹2,648 & ₹2,500—fall below could lead to ₹2,469.

Market revival ahead: Once SEBI completes probe or permits new players, volumes may bounce back. Long-term outlook remains positive on integrity grounds.

Big picture: India’s Sensex rallied ~8% in early 2025. If mid‑caps and small‑caps gain traction, high‑quality infra like BSE may gain more limelight.

FAQs: BSE Ltd share price

Q1: What is the current BSE Ltd share price?

A1: As of July 4–6, 2025, it’s trading around ₹2,635—down ~6.5% since SEBI’s ban.

Q2: Why did BSE stock fall?

A2: SEBI banned Jane Street due to suspected derivatives manipulation, leading to market fears of reduced F&O volumes.

Q3: Is this a buying opportunity?

A3: If you believe SEBI’s move boosts market trust and volumes recover, BSE could be a solid long‑term play. But wait till the dust settles.

Q4: What’s the outlook on derivatives volumes?

A4: SEBI stats show June F&O volumes dropped ~13% on BSE. Markets expect a bounce after clarity—analysts say current lows are temporary.

Q5: Will Sensex benefit?

A5: With Sensex up ~8% H1 2025, strength in large‑caps could lift all boats. BSE, as an infrastructure provider, stands to gain along with broader market growth.

Bottom Line

SEBI’s bold action against Jane Street shook the derivatives world—and BSE Ltd took the hit with ~7% share‑price cut. Yes, short‑term pain is real—but for long‑term investors, cleaner, more regulated markets are good news. Keep an eye on volume recovery, technical support levels, and India’s broader Sensex momentum.

[…] Also Read – Why BSE LTd Price Dropped by 6-7 %. […]