What the new modified Income Tax Bill 2025 means for taxpayers—simpler wording, better tax refunds, home loan interest relief and more. Explained clearly.

New tax regime 2025: Modified Income Tax Bill 2025 Unveiled

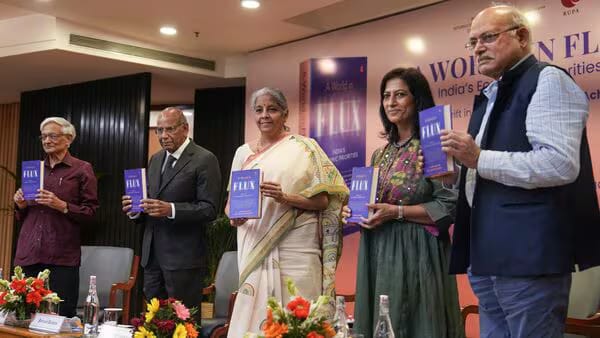

Today, August 11, 2025, Finance Minister Nirmala Sitharaman introduced the modified Income Tax Bill 2025—formally called The Income-Tax (No.2) Bill, 2025—in the Lok Sabha. This version replaces the old Income Tax Act of 1961 and includes almost all recommendations made by the Parliamentary Select Committee, to make the tax law easier, clearer and fairer.

Why Was the Original Bill Withdrawn, and What’s New in New Tax Law?

In early February, the government introduced a bold new Income Tax Bill aiming to replace six decades of tax rules. But when the Lok Sabha was adjourned in August, the Bill was withdrawn to avoid confusion over multiple versions.

A Select Committee, chaired by Baijayant Panda, gave 285 suggestions. Instead of passing each change one by one, the government wisely rolled them all into a fully updated version—the Income-Tax (No.2) Bill, 2025.

This new Bill cleans up drafting errors, aligns phrases, fixes cross-references, and responds to stakeholder feedback to make legal meaning more accurate and user-friendly.

What Does the Modified Bill Includes?

Clearer, Fairer Refund Rules

Earlier, tax refunds were denied if ITR returns came in late. That’s gone now. You can claim a refund when you file—no more silly technical hang-ups.

Also Read – Stainless Steel water Bottle News Update.

Better Definitions for ‘Relative’

How we define “relative” matters in tax. The committee cleared up confusion—now it clearly means both maternal and paternal ascendants and descendants. No more guess-work.

Relief on ‘Income from House Property’

Clause 22 now affirms a 30% standard deduction on rental income and lets you claim pre-construction interest on home loans in five equal parts after construction completes—great news for homeowners and property investors.

Broader Tax Benefits Bringing Clarity

The new Bill also covers the Unified Pension Scheme (UPS), allowing taxpayers to enjoy the same benefits previously exclusive to the New Pension Scheme (NPS).

A Fresh Breath of Tax Relief in New tax regime 2025

No more needless confusion—only one clear version of the Bill.

Smoother refunds and simpler wording—makes life easier for every taxpayer.

Support for homeowners—actual deductions you can plan around.

Relief for working and retired individuals—especially with pension-related clarity.

Parliamentary Affairs Minister Kiren Rijiju reassured everyone: the essence of the original Bill remains intact, just polished and clearer—no radical changes undermining its spirit.

FAQs: New tax regime 2025

When was the modified Income Tax Bill introduced?

August 11, 2025, in Lok Sabha.

Why was the original Bill withdrawn?

To avoid confusion—too many versions floating around. Better to table a single, updated draft.

Who guided the changes

The Select Committee, led by MP Baijayant Panda, made 285 suggestions, mostly accepted by the government.

What’s new in the modified Bill? New tax regime 2025?

Clearer refund rules, better definitions of relatives, homeowner tax benefits, updated pension tax norms.

How does this affect homeowners?

You get a 30% standard deduction on rental income and can split pre-construction home loan interest into 5 parts.

Will tax reform continue?

Yes—it’s a major step toward simplifying decades-old tax laws and helping everyday taxpayers.

Final Thoughts: New tax regime 2025

This modified Income Tax Bill is a smart, human-first step in India’s tax reform story. It shows the government listened to expert and citizen feedback—and acted. It’s more than a law—it’s a sigh of relief for taxpayers, property owners, and pensioners alike.

[…] Also Read – New Tax Regime 2025. […]