How $7 billion of institutional trust in Ethereum ETFs could reshape the crypto world—what it means for long-term investors, price trends, staking, and global finance.

$7 Billion Institutional Trust in Ethereum: Is Crypto’s Future Changing?

Big moves are happening in the crypto space. Over $7 billion has flooded into Ethereum spot ETFs recently, thanks to SEC approvals. That’s a massive shoutout from big institutions. But can this level of trust truly reshape the crypto markets?

What’s Driving ₹7 Billion Trust in Ethereum?

Spot Ethereum ETFs Gain Approval

The U.S. SEC recently greenlit eight spot Ethereum ETFs, making it official—and easy—for institutions to invest in ETH without holding it directly.

These ETFs saw $1 billion inflows in just five days—the fastest pace ever.

Big Names Leading the Pack

Giants like BlackRock and Fidelity are at the forefront. BlackRock’s iShares Ethereum Trust pulled in over $394 million in a single day.

Also Read – Why Stock Market Is Down.

Ethereum Becomes ‘Digital Oil’

Ethereum isn’t just store-of-value; it’s a utility powerhouse powering DeFi, stablecoins, and staking. Institutions see it as an “interest-bearing” digital asset—unlike Bitcoin.

Why This Institutional Trust Matters

Deep Pockets, Stronger Markets

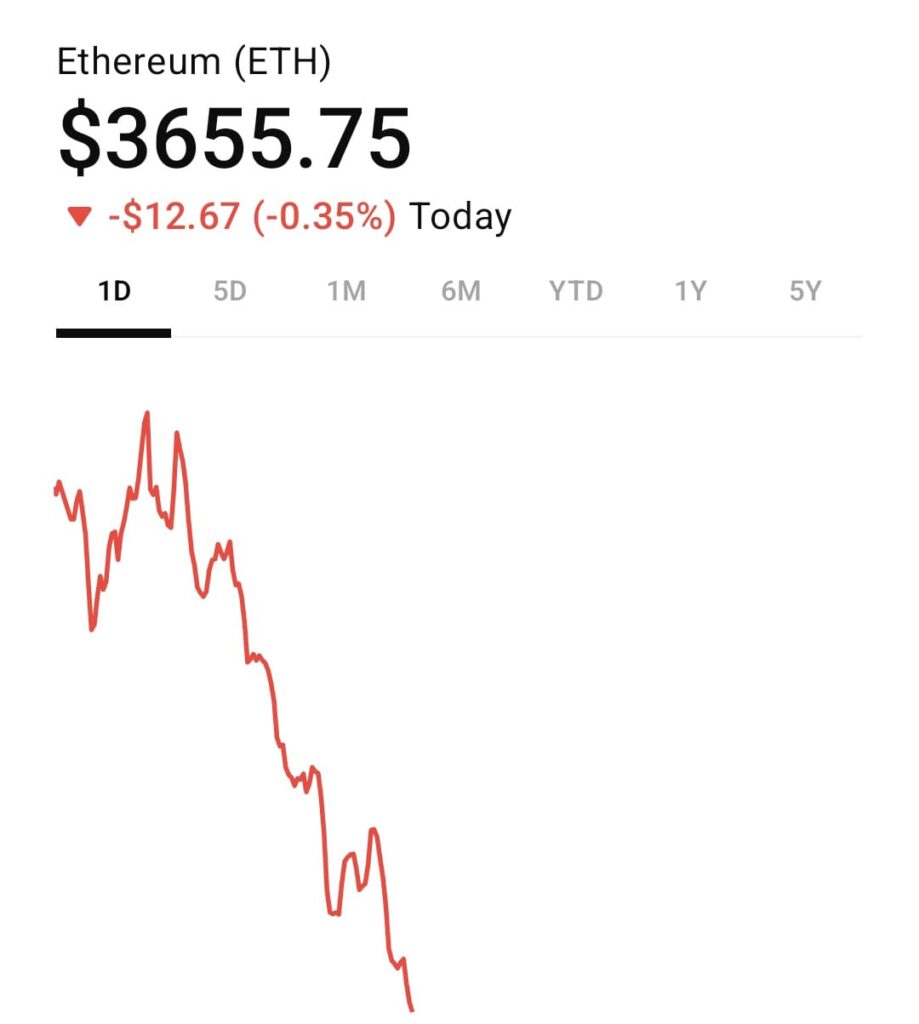

Institutional inflows bring stability. Unlike small-scale traders, big funds are in it for the long haul, with less panic-selling during dips. That’s why Ethereum recently hit a 6‑month high of $3,675.

Staking & Yield Build Confidence

Ethereum’s proof-of-stake model lets investors earn yield (~2–4%) by staking ETH—essentially interest on crypto. That turns it into a “digital bond,” making treasuries reconsider crypto as part of their portfolio.

Institutional Treasury Moves

Companies like BitMine, SharpLink, and Bit Digital now hold hundreds of millions in ETH, copying strategies used previously by MicroStrategy (with Bitcoin).

Ripple Effects on Crypto Market.

ETH Price Rallies

With a 40% price jump in July alone, Ethereum rose from $3,400 to highs above $3,700. Institutional interest and ETFs are major price drivers.

Stablecoin & DeFi Surge

More ETH in institutions means more fuel for DeFi platforms, stablecoins, and smart contracts. As on-chain activity increases, network utility and gas fee burns go up—driving scarcity.

Competition with Bitcoin

Unlike purely store-of-value Bitcoin, Ethereum offers productivity through staking and smart contracts—a shift many institutions are embracing.

Could This Change the Crypto World?

Regulatory Clarity Fuels Trust – The recent GENIUS and CLARITY Acts give legal certainty, positioning ETH-friendly policy for further growth.

Long-Term Institutional Holdings – With 1.7 million ETH locked in institutional reserves (~$5.9 billion), this capital is here for the long run.

Evolving Infrastructure – Companies like Galaxy facilitate staking, custody, and lending—allowing institutions to treat ETH as treasury-grade assets.

FAQs on Institutional Trust in Ethereum

Q1: What exactly are spot Ethereum ETFs?

They’re regulated funds that hold real ETH and let investors buy shares—no crypto wallets needed.

Q2: How fast did $7 billion pour in?

The first $1 billion arrived within five days. Total ETF inflows now tops $7 billion—fastest in crypto history.

Q3: Why are institutions choosing Ethereum over Bitcoin?

Ethereum offers staking yield, utility for DeFi and stablecoins, and programmable infrastructure—Bitcoin is mostly ‘digital gold’.

Q4: Will this affect ETH price long-term?

With steady buying, ETFs, staking, and usage increasing, the outlook is bullish. But market swings remain—so it’s not risk-free.

Q5: Is this bubble talk or real growth?

Unlike past hype, this is institutional, regulated, and utility-driven demand. While caution is wise, this flow feels foundational, not speculative.

Final Take: A Turning Point for Crypto?

Yes—it’s a big one. $7 billion in institutional trust isn’t just numbers; it’s a signal that crypto, especially Ethereum, is maturing fast. With legal clarity, staking yields, and growing on-chain utility, ETH is stepping up as a serious asset class.

For Indian investors, this could mean more global attention, better infrastructure like ETFs at home, and additional liquidity for trading ETH.

In short: this institutional wave could mark Ethereum’s rise from a niche asset to a mainstream building block for future finance.

[…] Also Read – 7 Billion Flood To Ethereum. […]