NSE India latest update 12 July: How SEBI’s ban on Jane Street hit NSE derivatives volumes, why market indices dipped, and how India’s IPO wave continues strong—easy read and actionable insights.

India’s stock world is buzzing.

NSE India Latest Update: What’s Happening and Why?

SEBI has banned U.S.-based trading firm Jane Street from Indian markets temporarily due to alleged manipulation in derivatives trading.

This shock has hit NSE’s derivatives turnover sharply, by about 21% down on July 10 vs July 3.

As a result, derivatives liquidity on NSE has dipped, raising concerns about reliability in these contracts.

Why Derivatives Turnover Fell 21% — What It Means

Jane Street was a major player in NSE’s derivatives market, especially index options and weekly futures.

Once banned, the total futures & options volume fell from ₹605 lakh crore to ₹476 lakh crore—a plunge of ‘near 21%’.

- That shows clearly: the exchange relies heavily on such players for smooth trading.

- Market Reaction: Sensex, Nifty Dip & NSE Valuation Wobble.

Also Read – Gold Rates in July.

Stock indices slump

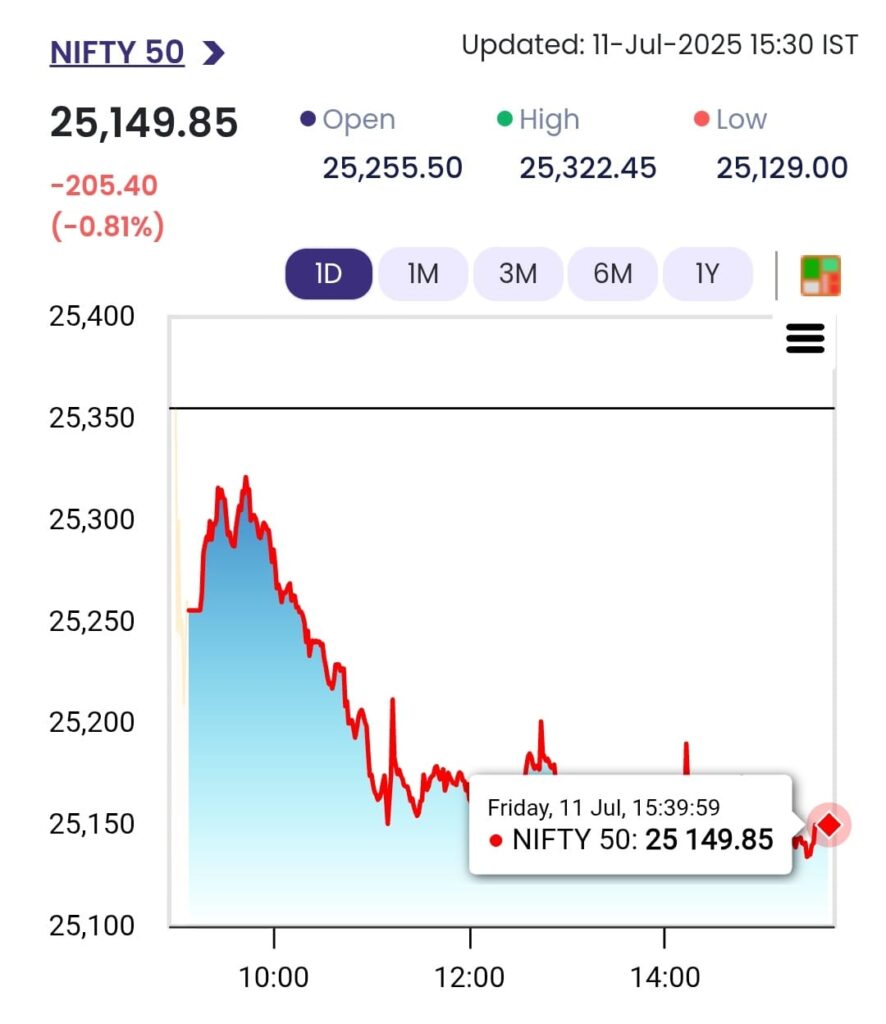

On July 11, 2025, Sensex fell 689 points (‑0.83%) to 82,500, while Nifty50 closed at 25,149.85, down around 205 points (‑0.81%).

The IT and auto sectors dragged markets lower, and investor mood turned cautious.

NSE’s pre‑IPO valuation takes a hit

NSE’s unlisted shares, once priced around ₹2,400 in private markets, dropped nearly 10% to ₹2,100‑2,150 after the Jane Street ban news.

The drop shows investors worry that derivatives traffic slowdown could hamper NSE’s IPO prospects.

But IPO Market Is Still Hot

In contrast, India’s IPO scene is thriving—$6.7 billion raised in 2025 so far vs $5.4 billion last year.

Big names like Tata Capital, Groww, and Meesho are getting ready to list soon.

Analysts expect India to become the largest IPO market globally outside the U.S. this year.

What It Means for You — Investors and Traders

Stay alert on options & futures moves:

- Derivative activity may remain thin and volatile while regulators study the impact.

- If you trade index options or futures, watch volumes and spreads closely.

- Think long‑term if investing in IPOs.

- Though NSE shares slid in private markets, IPO momentum stays strong.

- If you’re looking at new public offerings, focusing on fundamentals and listing demand is smart.

FAQs

Q: What exactly did Jane Street do?

A: SEBI accused them of trading patterns where they inflated index stock prices (like Bank Nifty stocks), drew retail call buyers in, then reversed trades to profit. Jane Street denies it and claims it’s standard arbitrage.

Q: How big was the drop in NSE derivatives turnover?

A: About 21% drop in total F&O volume and number of contracts between July 3 and July 10.

Q: Will NSE still IPO?

A: The listing seems paused now due to uncertainty. But long‑term fundamentals remain strong and the IPO pipeline is robust.

Q: Is the equity market riskier now?

A: Markets are unsettled short‑term. If you’re a retail investor, avoid risky trades and stick to well‑researched long-term ideas.

Key Takeaways – Bottom Line for Investors

Derivatives trading volumes on NSE dropped sharply after the Jane Street ban, exposing market dependency.

Sensex and Nifty fell, amid volatility and trade concerns.

But India’s IPO boom continues, making the long horizon look bright.

If you’re an investor, stay informed, guard against short‑term shocks, and align with your risk tolerance.

[…] Also Read – NSE India Latest 12 July Update. […]

[…] Also Read – NSE Today’s Latest Update 12 July. […]

[…] Also Read – NSE Latest Update. […]