Gold rates 9 July 2025 update. Understand why rates are moving, expert outlook, city‑wise comparisons & what investors should do today.

Gold Rates India July 2025 – Fresh Update & Smart Insights

Feel like gold prices are jumping up and down? You’re not alone. Indian households and investors are keeping a close eye on them.

What’s the Latest on Gold Rates – July 9, 2025?

Spot gold globally hovered near one‑week low—around $3,301–3,310 per ounce, as a stronger U.S. dollar and rising Treasury yields weighed on prices.

In India, 24K 10 g gold prices dropped sharply by ₹5,400 per 100 g (₹540 per 10 g) on July 7, marking a meaningful dip.

Also read – Today’s Nifty & Sensex Price.

By July 8–9, gold bounced modestly to ₹9,884–9,900/ g for 24‑carat and ₹9,060–9,076/ g for 22‑carat in key metro cities like Delhi, Lucknow, Hyderabad, Chennai, Bangalore and more.

RSI rise: According to ICICI’s report, gold may be heading toward the psychologically important mark of ₹1 lakh per 10 g during 2025.

Why Are Gold Prices Changing? Let’s Dive In

Global factors:

- Strong U.S. dollar & rising bond yields – Gold often moves inversely with the dollar. A stronger greenback makes gold costlier for buyers outside the USA.

- U.S. trade and tariff policy – Donald Trump’s latest word on tariffs (copper, semiconductors, BRICS countries) sparked investor caution—but some deals easing temporarily knocked gold prices down.

- HSBC’s bullish forecast – Experts now expect 2025 gold averages above $3,215/oz, potentially reaching $3,600+ levels.

Domestic and local cues:

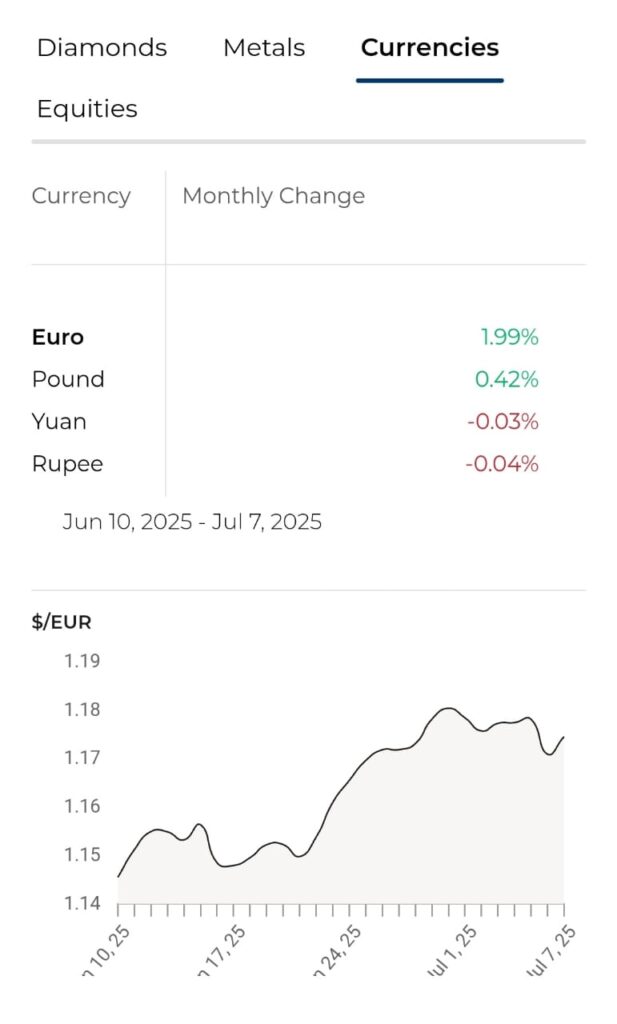

- Rupee movements – INR depreciation pushes gold higher locally. June saw a 0.2% INR fall, nudging gold up ~0.6%.

- MCX trading swings – Sudden dips like ₹500/10 g happen fast, influenced by global news, and they directly impact customer sentiment.

- Seasonal demand rises – Weddings and festivals in later 2025 are expected to lift demand—and prices.

City‑Wise July 9 Gold Rates (Rate per Gram)

| City 24K (₹/g) | Charge (Δ) 22K (₹/g) | Change (Δ) |

| Delhi | 9,900 +1 | 9,076 +1 |

| Lucknow | 9,900 +1 | 9,076 +1 |

| Mumbai | ~9,884 – | ~9,060 – |

(All inclusive of market swing; GST, making charges extra.)

Expert Outlook – Is ₹1 Lakh/10 g Gold on the Horizon?

ICICI Global Markets sees gold potentially reaching ₹98,500–1 lakh per 10 g in H2 2025.

HSBC raised their 2025 average forecast to $3,215, and expects prices to swing between $3,100–3,600, considering global uncertainties.

ET Analysis suggests cautious ranges for short‑term appetite, but the long‑term trend remains upward due to safe‑haven demand and inflation fears.

What Should You Do Today? Smart Tips for Buyers & Investors

- Track global cues daily – U.S. Fed updates, dollar trends, tariffs directly sway gold.

- Set your price zone – Plan to buy if gold drops to a support zone, say ₹9,700–9,800/g for 24K.

- Long‑term view? – Stay invested. If price goes to ₹1 lakh, it’s still a hedge.

- Gold loan pressure? – Avoid last‑minute purchases (like weddings), buy early in good deals.

- Diversify smartly – Mix of digital (sovereign gold bonds, ETFs) and physical gold can reduce risk.

FAQs

Q1: What is the 24‑carat vs 22‑carat gold price difference?

A1: 24K is pure gold (999 fineness) and costs higher per gram. 22K is alloyed (about 917 fineness), slightly cheaper, and used in jewellery. Both follow spot gold but differ on purity.

Q2: Why did gold fall ₹540 on July 7 in India?

A2: A combination of strong dollar, trade optimism in the U.S., and some INR strength caused a ₹540 drop per 10 g (₹5,400 for 100 g) on July 7—consistently cited by Indian market reports.

Q3: Will gold hit ₹1 lakh per 10 g in 2025?

A3: Quite possible—several heavyweight reports (ICICI, HSBC) predict gold trending up to ₹98,500–1 lakh in H2 2025 due to global inflation and currency moves.

Q4: Should I buy today or wait?

A4: If your goal is short‑term profit, wait for a dip into support zones (₹9,700–9,800). If it’s a long‑term hedge/investment, small lumps regularly (SIP style) work better than big chunks.

Q5: How much is the charge and GST?

A5: Making charges vary (4–12% for jewellery), GST is 3% flat on metal. Always ask the jeweller up front—these costs add significantly.

Q6: Which form of gold gives better “returns”?

A6: Sovereign Gold Bonds (SGBs) earn ~2.5% interest annually and track gold price. Gold ETFs give convenience with small charges. Physical jewellery has making charges and is illiquid, but has emotional value.

Final Word

Gold is volatile short‑term, but trendwise it’s stepping higher. Smart buyers watch daily dips and global signals, while long‑term investors stay steady. With ₹1 lakh/10 g on the radar, one thing’s clear—gold won’t go unnoticed in India’s financial story for 2025.

[…] Also Read – Gold Rates in July. […]