Stay updated with the latest Gold Rate in India Today (8 July 2025). Current 24K, 22K, 18K prices, why rates are shifting. Should You Invest?

Gold prices in India are on a gentle dip today – but that’s far from the full picture. Whether you’re shopping for jewellery, investing, or just curious, this post has everything you need: real-time rates, why they’re changing, and what experts foresee next.

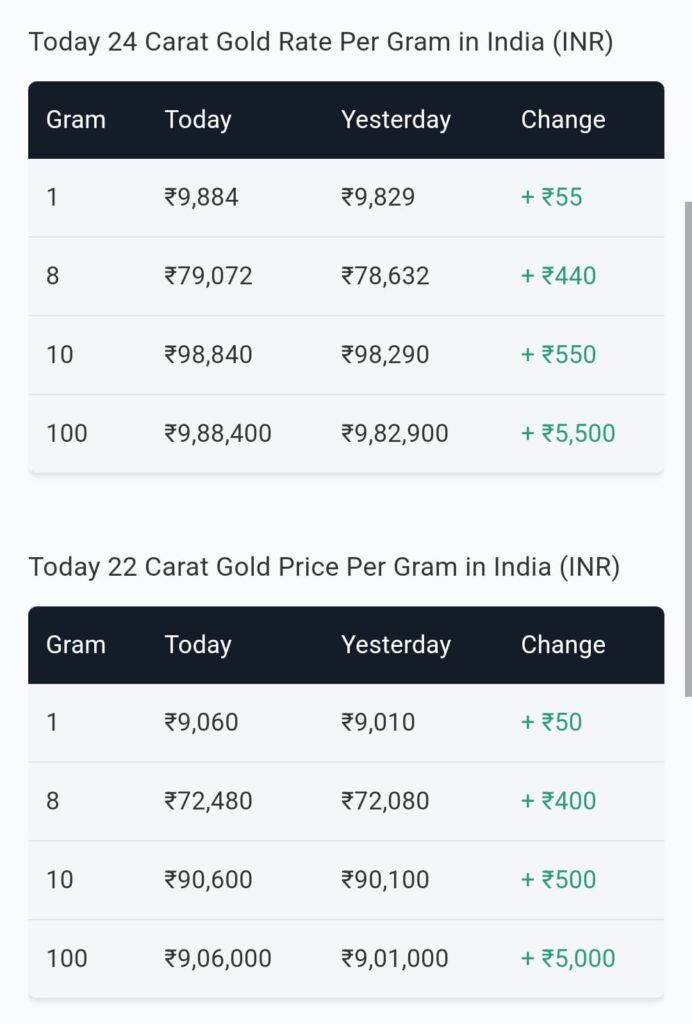

According to GoodReturns, on 8 July 2025:

24‑carat gold: ₹9,828 per g (down ₹1)

22‑carat gold: ₹9,009 per g (down ₹1)

18‑carat gold: ₹7,371 per g (down ₹1)

In major metro cities like Bangalore, Delhi, Mumbai, Chennai and more, these tiny changes are consistent—markets moved down just ₹1 across carats. A calm day, but even small shifts can matter for your investment or upcoming purchases.

Why Did Gold Prices Dip Today?

Two key factors are at play:

- Global Trade News Eases Safe-Haven Demand

Breaking global news: gold prices slid about 0.7% recently because the U.S. extended certain trade tariff reprieves. This defense trade-off dampens demand for gold as a safe haven. - Sharp Price Drops this Week

In India, the week began with a surprise – ₹5,400 per 100 g drop in 24K rates (₹540 per 10 g) on 7 July, due to global uncertainty around US tariff deadlines.

One-Week Gold Price Trend (24K, ₹/10g)

Date Change:

July 1 ₹97,400 (+₹1,190)

July 3 ₹96,900 (–₹500)

July 7 ₹98,290 (–₹5,400)

July 8 ₹97,400 (–₹890)

This same rhythm is seen in 22K and 18K – sharp ups, sudden drops, and today’s slight pause.

Also Read – Indian Economy and Market Price.

Expert Insight – What Analysts Say

LKP Securities’ Jateen Trivedi noted that US tariff timelines and lingering uncertainty are keeping gold in a cautious range of ₹95,500–97,500 for 10 g of 24K.

RSBL’s Prithviraj Kothari pointed out that US employment data and delayed tariffs are key:

“Gold prices are consolidating in a symmetrical triangle … $3,300 (₹98,500) is strong resistance”.

This means watch for crucial breakouts or breakdowns—gold could swing 2–3% if those levels are breached.

What Does It Mean for Buyers & Investors?

- Buyer’s delight: If weddings or festivals are around the corner, moderate dips offer a small window for savings.

- Investor’s alert: Traders should monitor global triggers—trade deals, US Fed minutes, and labour data could tip gold’s direction.

- Long-term lens: Gold remains a safe-haven hedge. Even with short-term dips, global uncertainty could push prices up again.

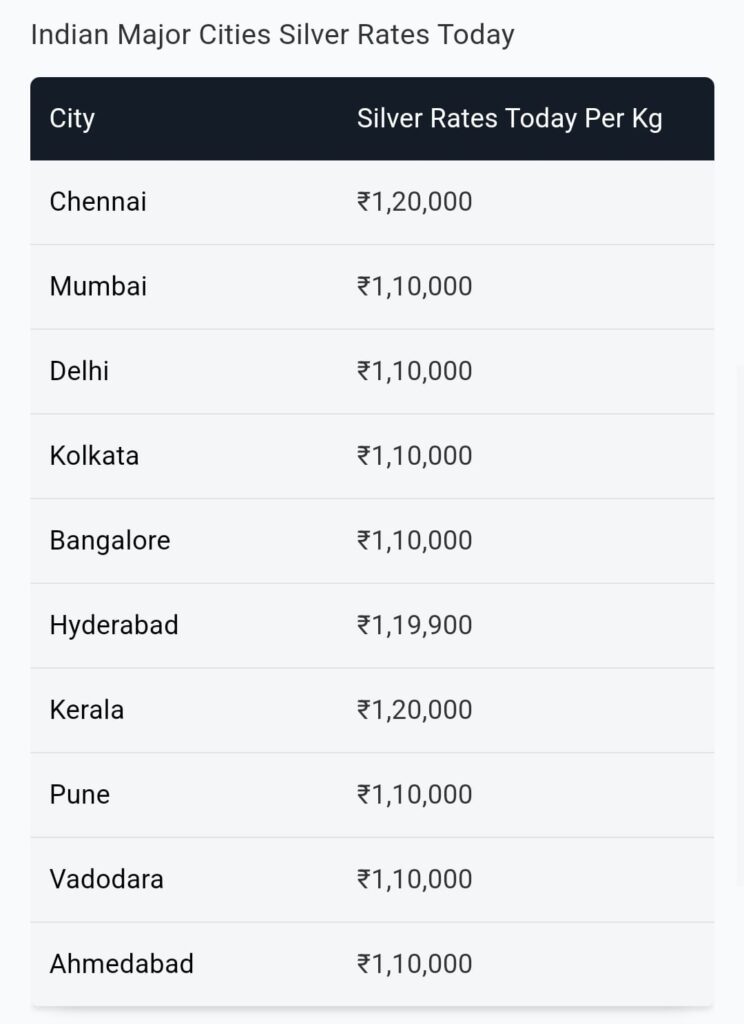

City-Wise Snapshot – ₹/g Gold Rates (8 July 2025)

- Mysore: 24K at ₹9,828, 22K at ₹9,009 (down ₹1 each).

- Vadodara: 24K ₹9,832, 22K ₹9,014 (–₹1).

- Chandigarh: 24K ₹9,843, 22K ₹9,024 (–₹1).

- Pune: same downtrend.

- Chennai, Mumbai, Nashik: consistent ₹1 drop across carats

The takeaway: Today’s minor dip is widespread—there’s no big city-level advantage.

FAQs: Gold Rate in India Today

Q1: What is the current price of 1 gram 24K gold today?

A1: ₹9,828 per gram as of 8 July 2025.

Q2: How much is 10 g of 22K gold right now?

A2: ₹90,090 (₹9,009 × 10).

Q3: Why are gold prices dipping?

A3: Global trade news and US tariff delays lowered safe-haven demand.

Q4: Will gold go higher soon?

A4: If trade tensions flare again or US inflation stays strong, gold could surge. Watch support at $3,300/oz and resistance at $3,400/oz (₹96k/₹98.5k).

Q5: Is today a good time to buy gold?

A5: If you need it soon, today’s dip helps. For investors, consider your risk appetite—buying at lower rates can pay off if prices rebound.

Bottomline: Should You Watch Gold Today?

Absolutely. Even when the changes seem small, gold reacts quickly to global events. Today’s dip is mild—but the underlying story is dynamic:

- U.S. trade negotiations.

- Fed policy shift.

- Global economic confidence.

All eyes are on what happens next. For buyers, it’s a calm moment. For investors, it’s a pause—and a prompt to stay informed.

[…] Also Read – Gold Rate In India 8 July 2025. […]