India stocks markets 8 July 2025 Update: Nifty‑Sensex range‑bound moves, bank & midcap trends, and expert levels shape India’s stocks & markets this month.k

Right now, Indian markets are calm yet watchful.

Market Performace — Flat & Waiting

Markets have been in a holding pattern:

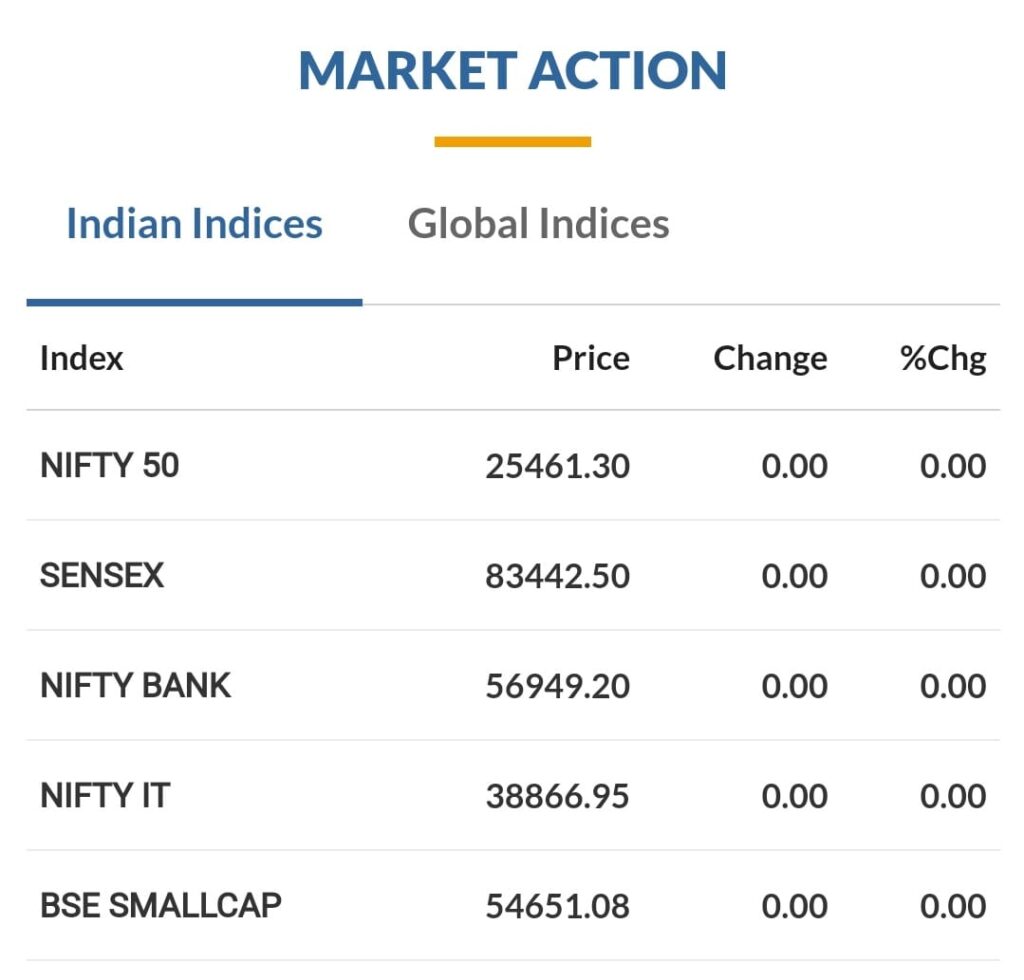

Nifty 50 is stuck around 25,460–25,500, with little movement.

Sensex closed at 83,442, just about flat over the recent week.

India VIX sits at 12.5–12.6, showing no high volatility—investors feel stable, not panicky.

Why this stillness? All eyes are on trade‑deal updates—especially looming US tariffs effective August 1—and upcoming corporate earning reports.

Trade Tensions Take Centre Stage

Heavy U.S. tariffs are hitting 14 countries from August. That’s spooking markets globally:

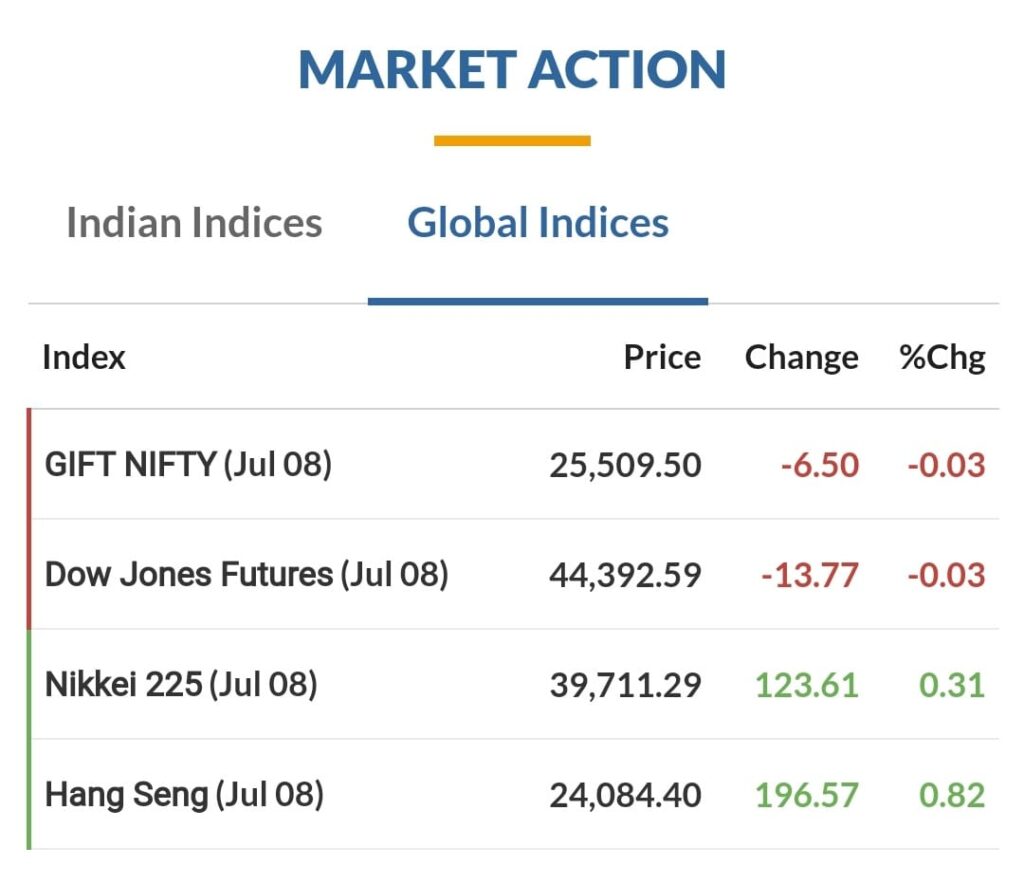

GIFT‑Nifty signalled weakness in early trades, showing investor jitter.

Experts suggest fresh trade-deal clarity—especially India‑US—could tip the markets either way.

Key Technical Levels to Watch

Traders are tracking two important ranges:

- Support band: ~25,300–25,350. A breakdown below that might lead to 25,200–25,100.

- Resistance zone: ~25,500–25,700. A move above 25,500 could push markets toward 25,650–25,700.

So, unless a major global or domestic trigger hits, expect markets to hover in this 400‑point band.

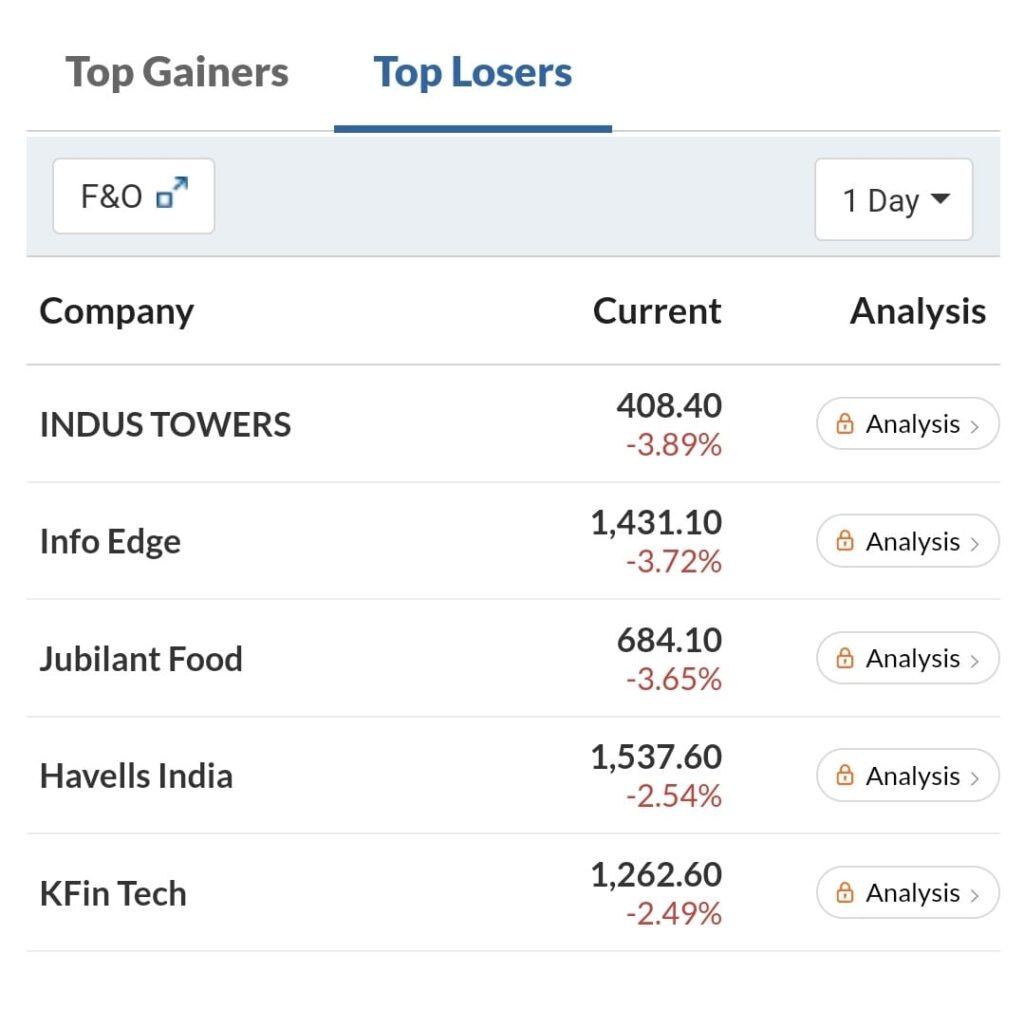

Sector Watch — What’s Leading & Lagging

FMCG & Oil & Gas Shine.

In a recent session:

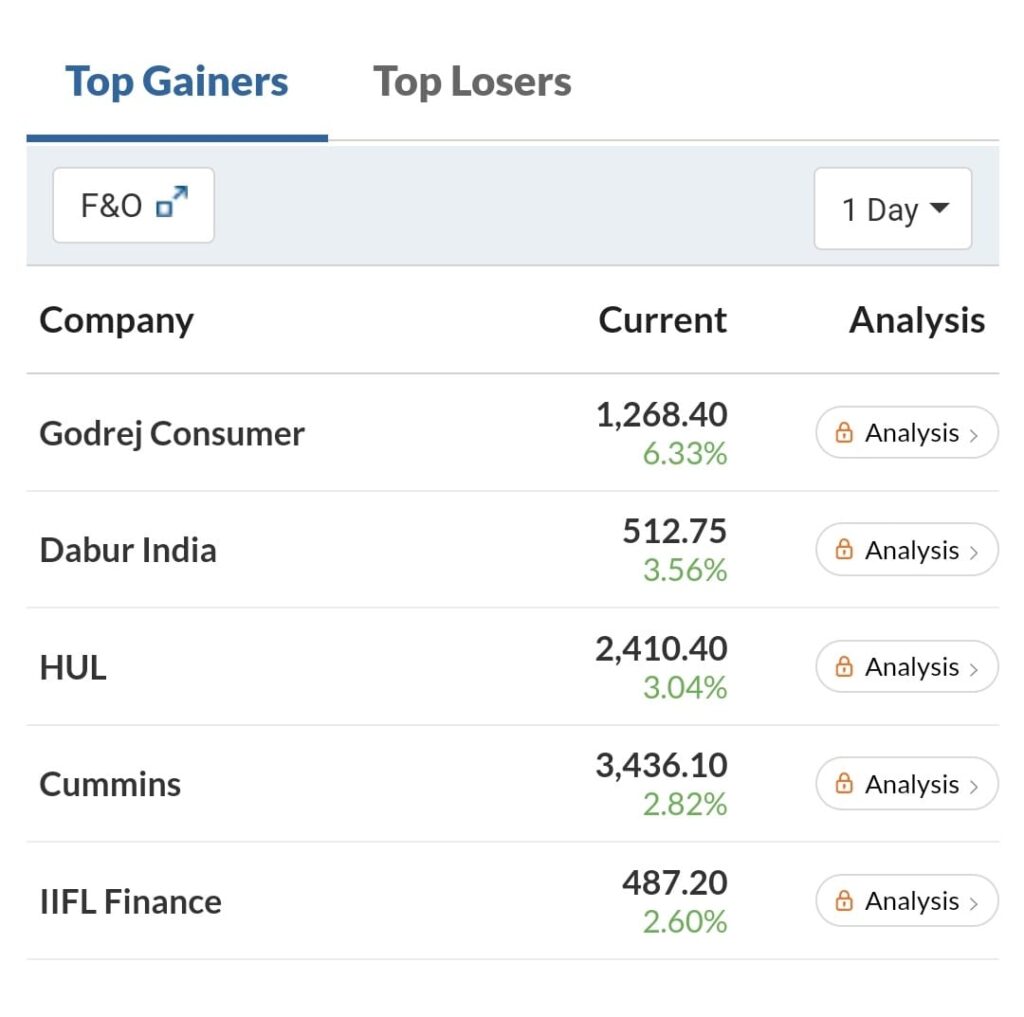

- The FMCG sector rose ~1.6%.

- Oil & Gas added ~0.4%.

FMCG did well on robust Q1 earnings and steady consumer demand—defensive winning in choppy times.

IT, Metals & Auto Slump

Contrast that with:

IT and Metals fell ~0.7% each, weighed by global concerns.

Auto stocks slipped on higher U.S. tariff fears.

Banking & Mid‑Caps Mixed

Nifty Bank ended slightly down (~–0.15%), with margins near key MAs.

Nifty Midcap and Smallcap indexes drifted lower (~–0.3 to –0.4%).

Next‑50 Stocks Picking Up

Nifty Next 50 gained ~0.17%, near 68,725–68,770.

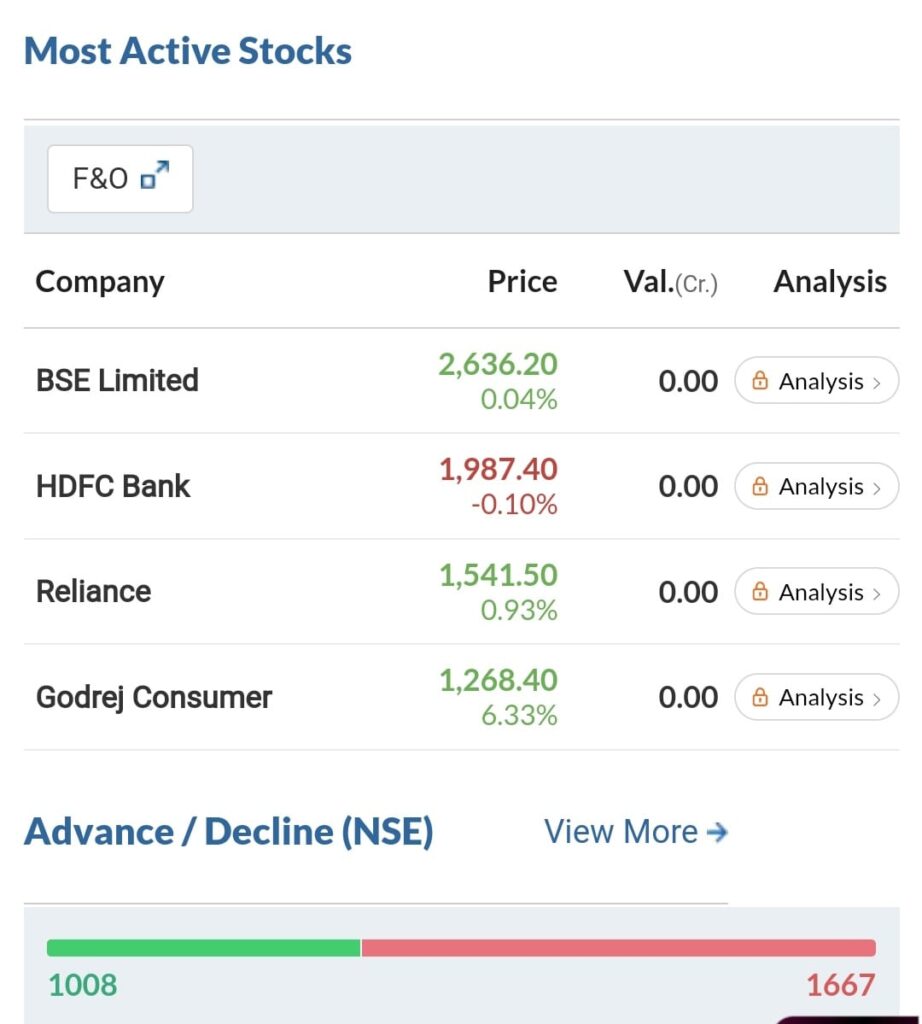

Stocks like Godrej Consumer and Bosch showed strong volume-backed gains.

Also Read – All Gold Purity rates.

Key Takeaways for Traders & Investors

- Markets are calm, with low volatility—not much fear, not much excitement.

- Watch 25,300–25,350 support, and 25,500–25,700 resistance for the next move.

- FMCG and Oil‑Gas sectors look defensive and steady.

- IT, Metals, Auto are under pressure due to global trade worries.

- Mid‑caps & Next‑50 offer selective opportunities, but remain cautious.

FAQs

Q) What is the current Nifty level?

Nifty is trading near 25,460–25,500, in a tight range this July 2025 session.

Q) Why are Indian markets so flat?

Markets are patiently awaiting trade‑deal clarity and quarterly earnings. India‑US tariff news could shake things up.

Q) Which sectors are performing best?

FMCG and Oil & Gas are the top performers, thanks to stable earnings and defensive demand.

Q) What are key support and resistance levels of Nifty?

Support zone is 25,300–25,350; resistance is 25,500–25,700. Below or above these could signal a breakout.

Q) Are small‑caps to watch?

Small‑caps and mid‑caps dipped ~0.3–0.4% in recent sessions. Better to wait for trade clarity before making a move.

Q) What about Nifty Next 50?

Next 50 are trading strong with ~0.17% gain. Stocks like Godrej, Bosch are seeing solid volumes.

Final Word On Today Market

To sum up, July 2025 markets are calm, range‑bound, and sensing opportunity. Nifty hasn’t moved much—until a major trigger appears, like trade‑deal clarity or strong earnings, expect this stable sideways path. FMCG and Oil & Gas look reliable; others need more global clarity. Watch the 25,300–25,700 zone closely for any breakout or breakdown.

[…] Also Read – Indian Market Outlook 8 July 2025. […]