Know the latest All Gold purity rates IBJA impact for 24K, 22K, 18K, 14K, 12K & silver. Understand how these benchmark prices affect your gold loan, jewellery buying and investments today.

Latest IBJA Rates for All Gold Purities & Silver – What It Means For You

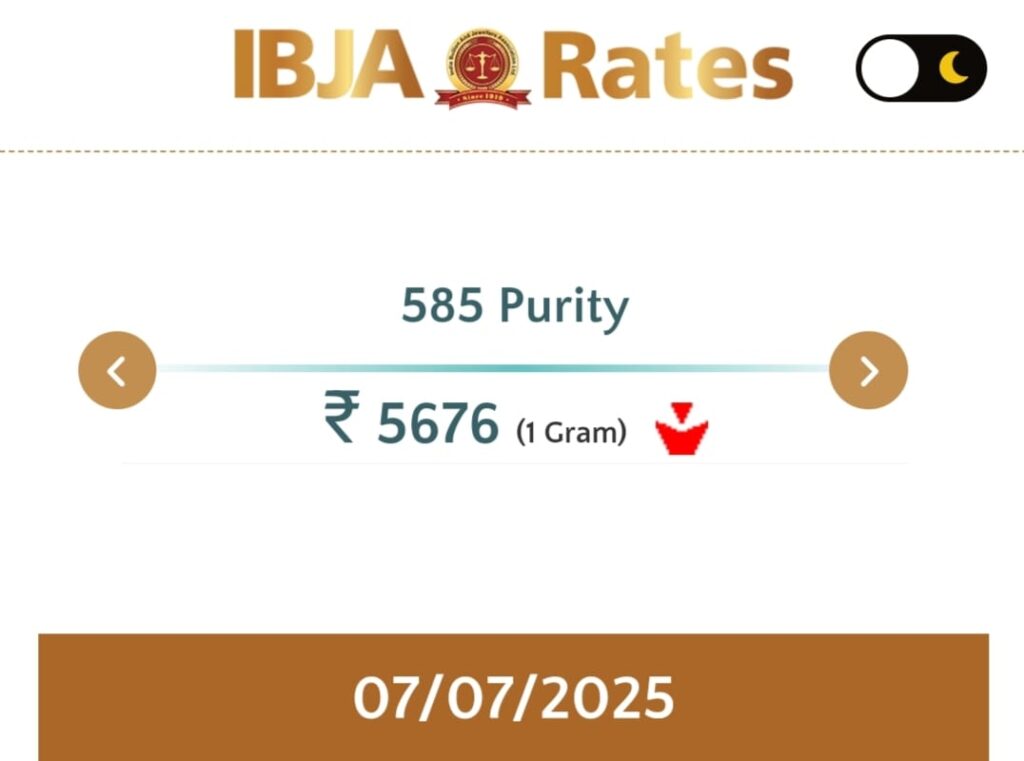

IBJA just shared the AM and PM benchmark rates for various gold purities and silver:

Latest IBJA Daily Rates (per 10 g for gold; per kg for silver):

| Purity | AM Rate (₹) | PM Rate (₹) |

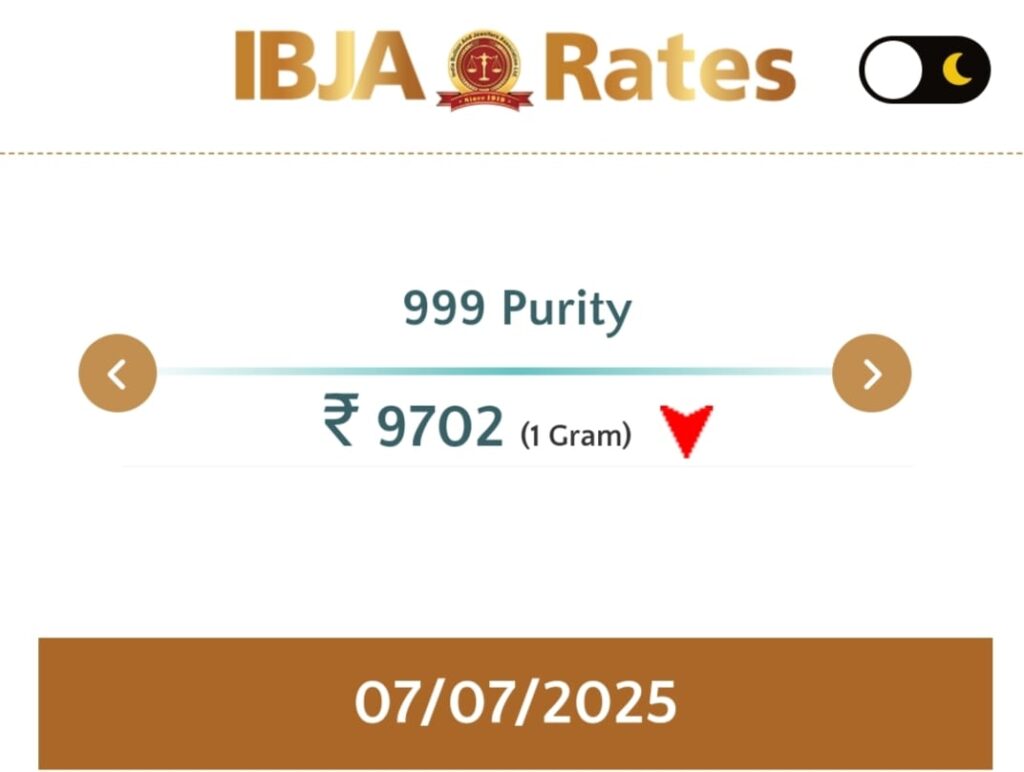

| Gold 999 (24K) | 96,988 | 96,747 |

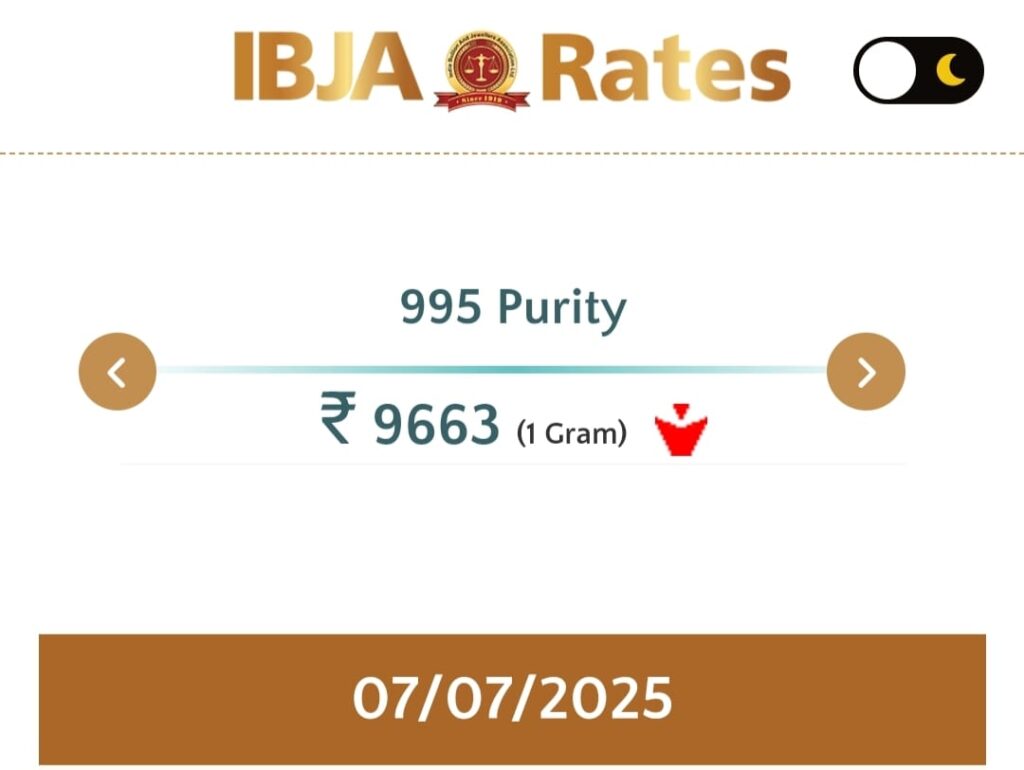

| Gold 995 | 96,600 | 96,360 |

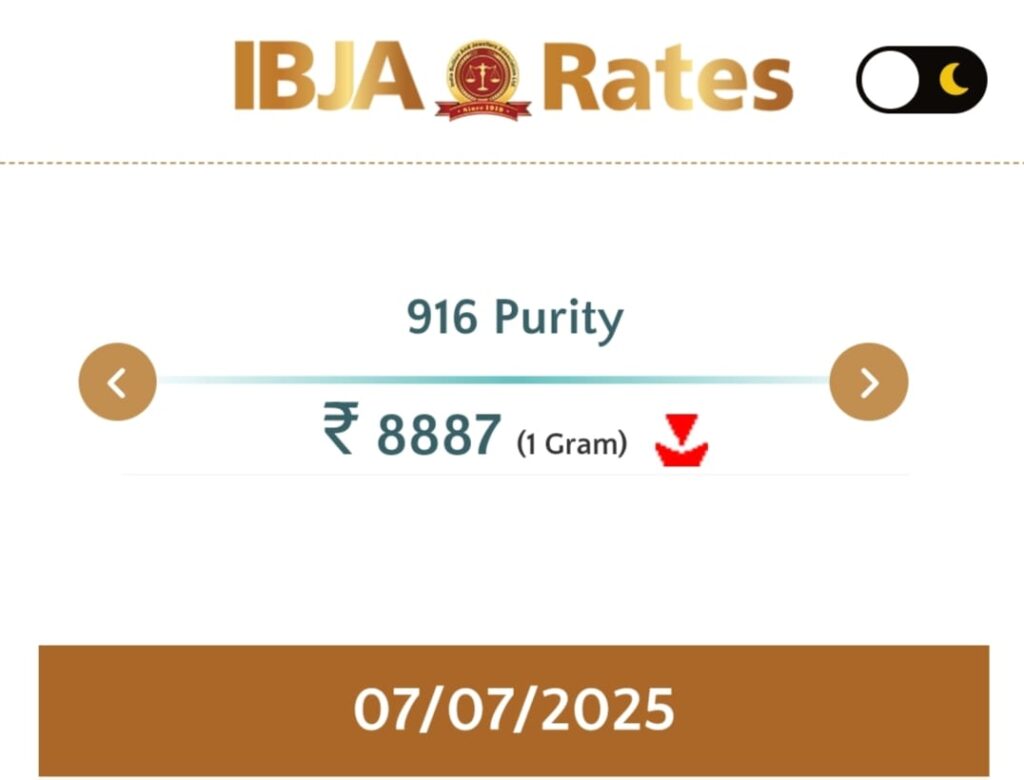

| Gold 916 (22K) | 88,841 | 88,620 |

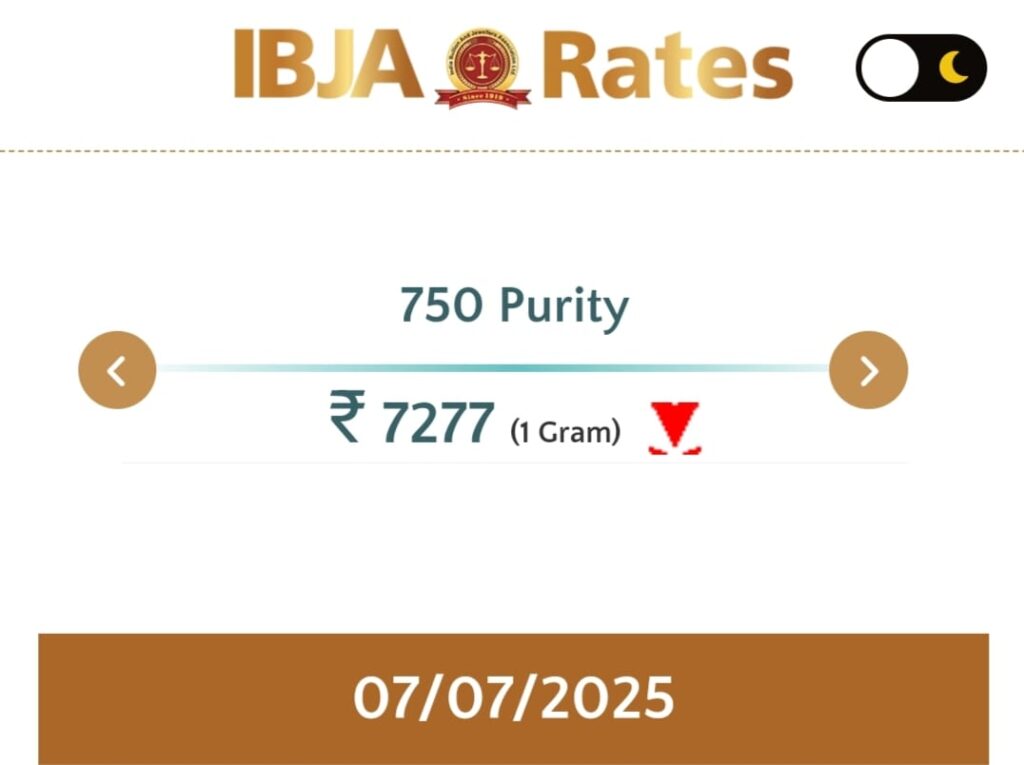

| Gold 750 (18K) | 72,741 | 72,560 |

| Gold 585 (14K) | 56,738 | 56,597 |

| Silver 999 | 1,01,000/kg | 1,00,980/kg |

(Today’s IBJA AM/PM numbers are from their June 5th report).

Why IBJA’s Full Purity Listing Matters

Most people only know about 24K and 22K. But rates for 18K and 14K (585 purity) matter too, especially for:

Gold loans – NBFCs and banks base lending on your jewellery’s real purity.

Jewellery makers – Purity affects both making cost and resale value.

Investors – Want the right variety for long-term gains (e.g., 18K can be cheaper but still valuable).

Also Read – Flat Start Of Sensex & Nifty on 7 July 2025.

Why Rates Rised This Week — Human Explanation

- Safe-haven buying – People bought gold as global uncertainty rose.

- Weak rupee – A weak rupee made imports costlier, pushing domestic prices up.

- Strength in silver – Silver demand gained as gold remained strong.

- Global central bank buying – More upsides due to institutional inflows.

How This Impacts You

- Gold Loans.

- If your jewellery is 18K or 14K, loan value changes distinctly from 22/24K.

- Rising rates mean you get less loan for the same weight.

- Jewellery Buying.

- Jewellers quote making charges over these benchmark rates—watch purity and timing (AM vs PM).

- Investment Planning.

- 18K/14K items can offer diversification and affordability.

- Silver now at ₹1 lakh/kg — a handy inflation hedge.

FAQs

Q1: What’s 14K (585) and 18K (750) gold used for?

14K has 58.5% pure gold—used in cost-effective jewellery; 18K has 75%—strong but shinier and more resale-worthy than alloys.

Q2: Why do PM and AM rates differ?

IBJA posts two rates daily — AM (opening) and PM (closing). Your loan or purchase uses whichever is closer at transaction time.

Q3: Does gold loan amount differ by purity?

Yes—banks calculate based on purity. A 10g 22K piece brings more loan than a 10g 14K piece, even if the weight is the same.

Q4: Should I buy 916 or 585 gold today?

916 (22K) is best for traditional jewellery; 750 (18K) and 585 (14K) are ideal if you prefer modern, lightweight designs with lower cost.

Q5: How often does IBJA update these rates?

Twice a day (AM/PM), except weekends or holidays. NBFCs and banks follow them for loans.

Table – Compare Your Options Easily

| Purity | % Gold | Current Rate (PM, ₹/10g) | Ideal Use | Loan Value |

| 999 (24K) | 99.9% | 96,747 | Pure investment, coins, SGBs | Highest |

| 995 | 99.5% | 96,360 | Near pure, but softer | Very High |

| 916 (22K) | 91.6% | 88,620 | Indian jewellery standard | High |

| 750 (18K) | 75% | 72,560 | Modern/Western jewellery | Moderate |

| 585 (14K) | 58.5% | 56,597 | Fashion/light jewellery | Lower |

| Silver 999 | 99.9% | 1,00,980/kg | Silver coins, ETFs, hedges | Calculated per kg value |

Final Thoughts – Smart Moves Based on Purity

- Planning a gold loan?

Know your purity—14K to 24K rates matter! - Buying jewellery?

Decide based on style, budget, and resale value. - Investing?

Mix purity levels and include silver for a balanced portfolio.

Act based on AM/PM rates—timing can save you ₹/gm!

[…] Also Read – All Gold Purity rates. […]