Sensex Nifty 7 July 2025 Price: Sensex & Nifty Begin Flat as India‑US Tariff Deadline Nears.

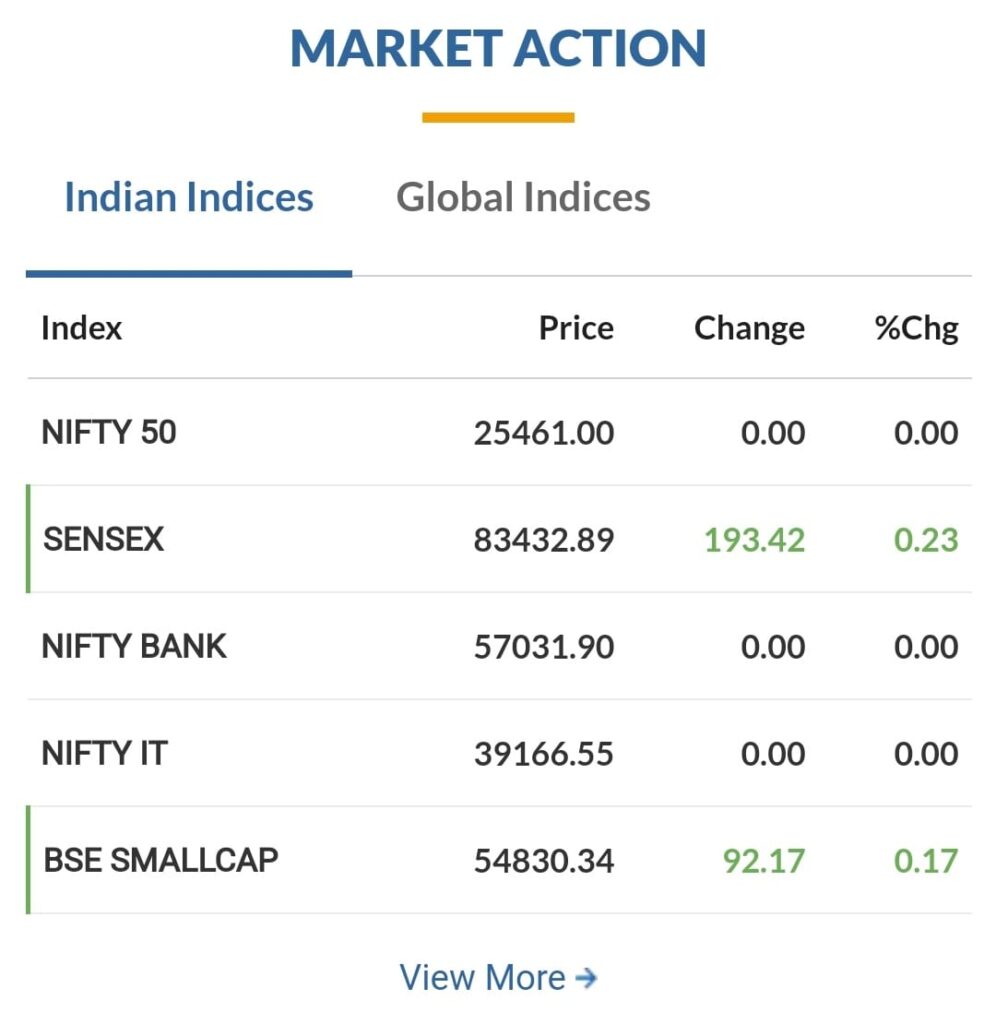

India’s two big benchmarks—Sensex and Nifty—opened nearly flat today on July 7, reflecting growing caution ahead of the looming India–US trade deadline on July 9. While the US hinted at delaying new tariffs, details are sketchy, so investors are holding back.

Also Read – Why BSE LTd Price Dropped by 6-7 %.

What’s Really Happening in the Markets?

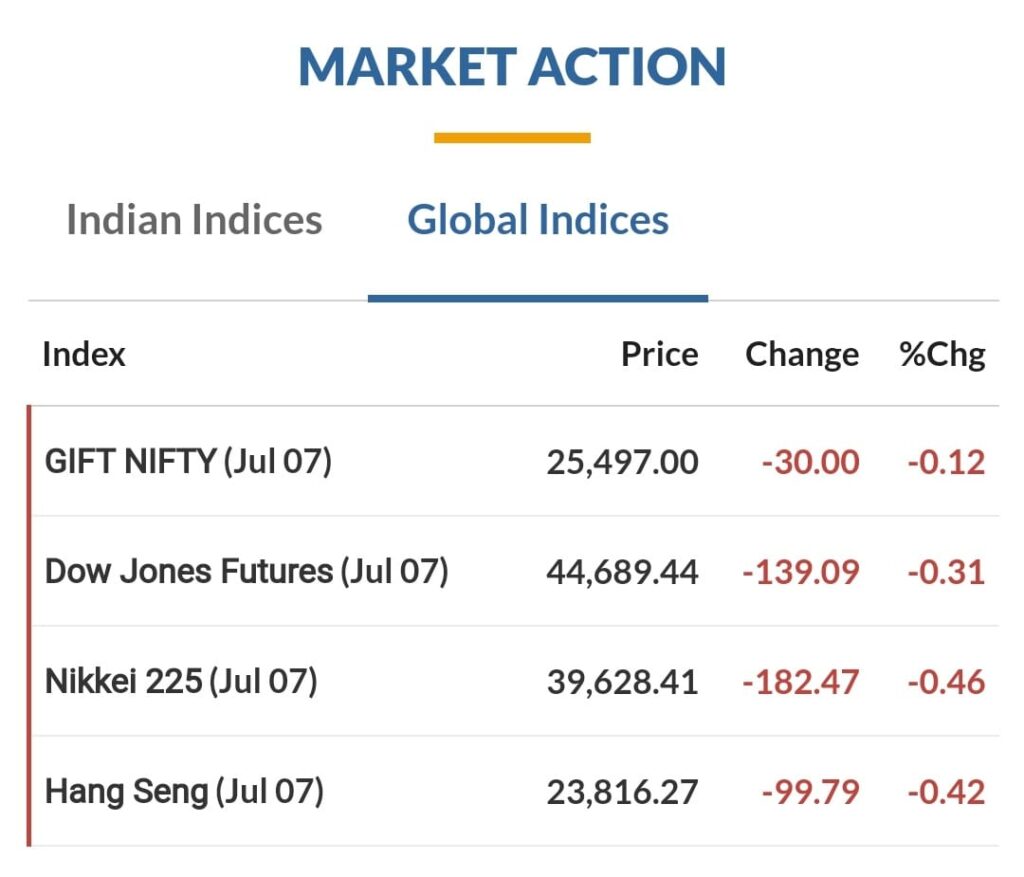

Gift Nifty futures point to a minimal gain—barely a ~0.03% uptick at open.

Sensex and Nifty ended flat on Friday, stuck in a narrow trading range.

The India VIX, a volatility gauge, hit a nine‑month low—bullish vibes remain intact.

Both Foreign and Domestic Institutional Investors sold shares worth Rs 760 cr and Rs 1,028 cr respectively on Friday.

Why the Flat Start? What’s the Big Picture?

- US Tariff Threat Looms

The deadline is July 9, and markets hate uncertainty. A delay might be good, but lack of clear info keeps traders on edge. - Trade‑Deal Hopes vs Fear

A possible India‑US agreement offers optimism, yet mixed global cues mean caution prevails. - Profit Booking & Technical Support

Nifty has recently slipped ~0.7% for the week, closing below 25,500. Support around 25,300–25,200 is holding, while resistance lies near 25,700–25,800.

Market Levels You Should Watch

Index Key Levels:

Nifty 50 25,200–25,300 (support); 25,700–26,000 (resistance) Below 25,200 may open downside; above 26,000 could spark fresh rally

Sensex 83,200–83,400 range Narrow range signals low volatility and hesitancy

India VIX Nine‑month lows Low VIX supports calm, bull‑friendly conditions

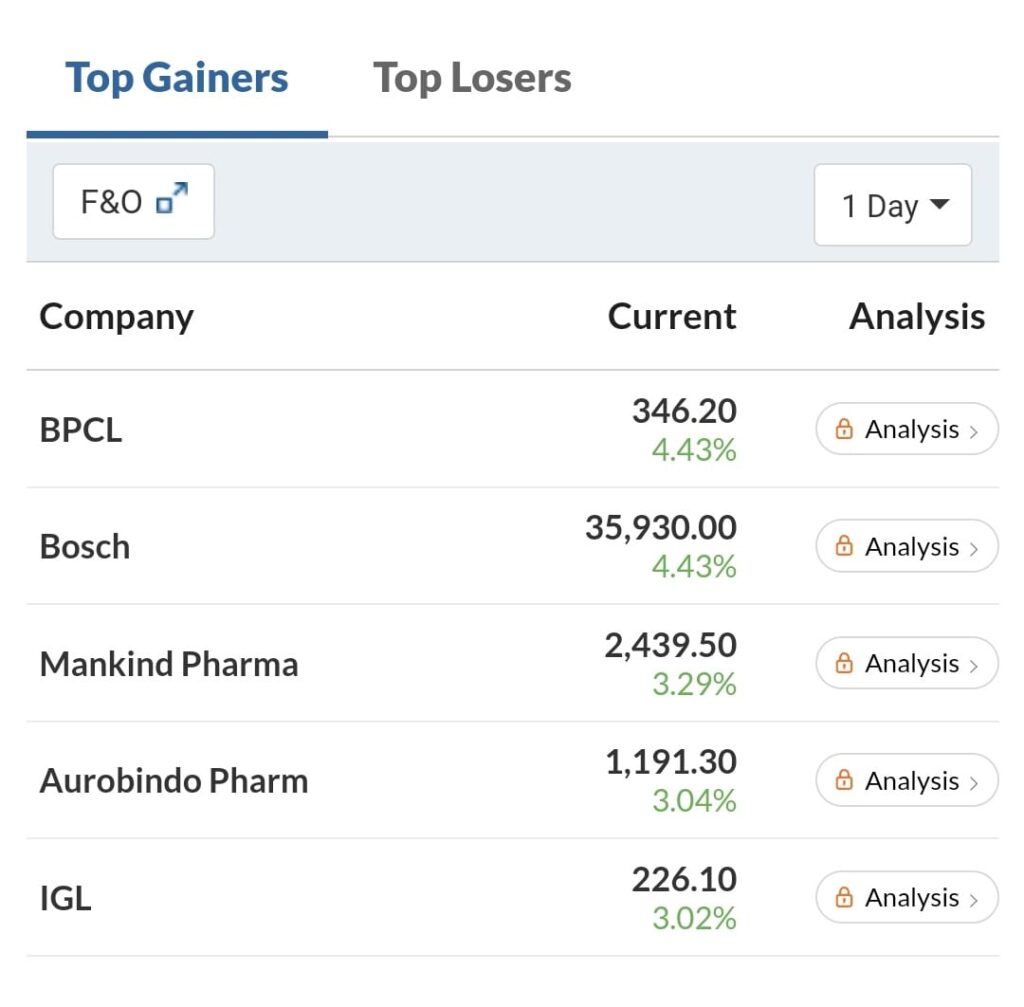

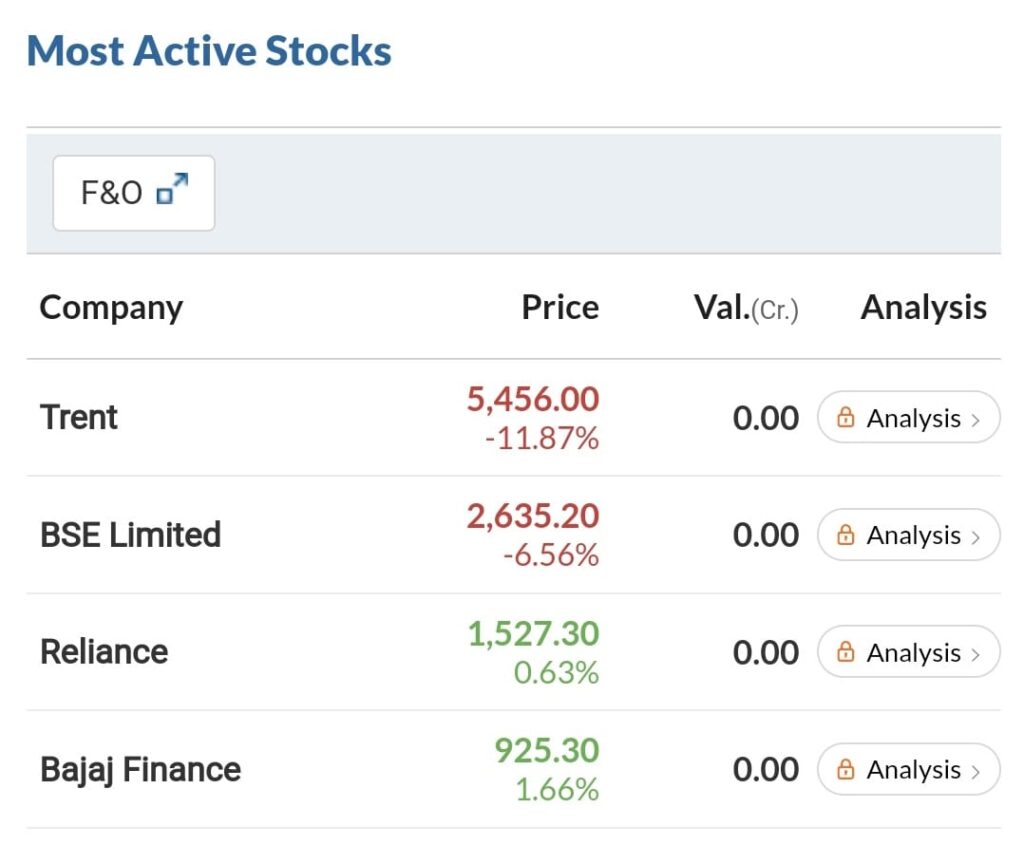

Which Stocks Are Worth Watching Now?

- Bajaj Finance hit its 52‑week high as AUM jumped by 25%.

- Marico rose ~3.6% on strong rural sales.

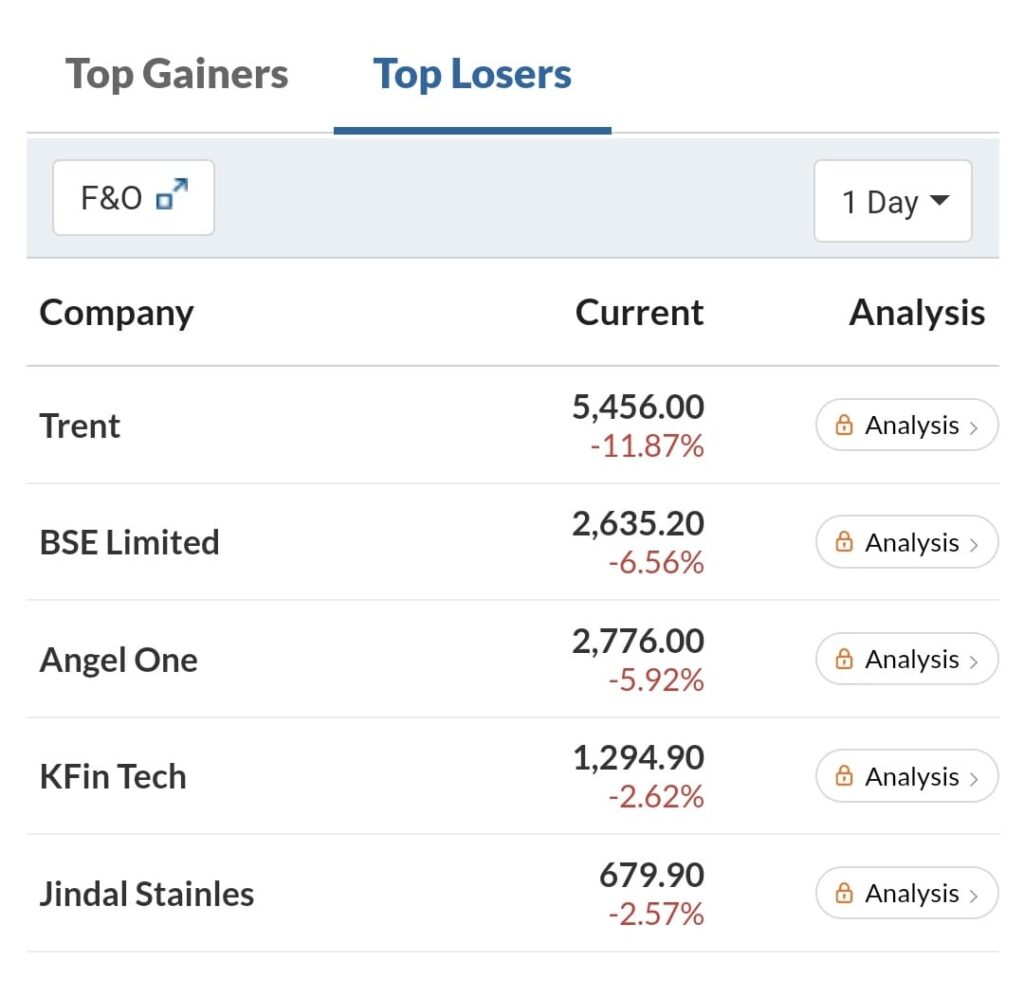

- Trent lagged (-7.2%) after weak June‑quarter results.

- BSE Ltd soared this year (~+223%), but fell 7% after SEBI banned Jane Street.

- Jane Street ban is fresh news – SEBI’s step against manipulation keeps markets alert.

- Bigger Picture – What Analysts Say

- Technical analysts point to July 10 as a key turning point for the Nifty trend.

- Sector focus: BFSI, metals, pharma, capital goods and consumption could lead to any breakout.

- Global risk: Any stray US tariffs or geopolitical tension could deflate sentiment sharply.

Sentiment & Power Words to Keep You Informed

Calm risk tone, thanks to low VIX and flat start.

Cautious optimism about a possible trade deal—don’t get too excited yet.

Opportunity lies ahead—support zones give smart entry levels.

Alert: Keep eyes on the July 9 deadline and possible technical breakout by July 10.

FAQs

Q1: Why are Sensex & Nifty flat today?

A: Markets are waiting for clarity on the US‑India tariff deadline on July 9. The lack of firm details has made investors cautious.

Q2: Is it safe to buy on dips around 25,200?

A: Yes—analysts say strong technical support lies between 24,900 and 25,300. Buying around these levels could make sense if global cues stay calm.

Q3: What’s the Jane Street ban all about?

A: SEBI accused Jane Street of manipulating BANKNIFTY and derivatives, banning it in India and ordering profits placed in escrow. It’s a win for retail safety but may spook quant traders.

Q4: Will Bajaj Finance and Marico keep rising?

A: Both posted solid numbers—Bajaj Finance’s AUM is up 25%, and Marico showed strong rural demand—suggesting they could lead in the current cautious market.

Q5: What’s the significance of July 10?

A: Technical experts see it as the likely ‘breakout or breakdown’ day for Nifty—watch index moves around then.

Final Word – What Should YOU Do on 7 July 2025?

- Watch 25,200–25,300: A drop below this could bring more correction.

- Buy dips cautiously: Analysts suggest buying support zones with small-sized trades.

- Stay updated on US‑India talks: Any news there can swing the market.

- Follow stock stories: Companies like Bajaj Finance or Marico may offer growth in a flat market.

Table – Quick Market Snapshot

Item Detail

| Item | Details |

| Nifty Opening Flat | GIFT Nifty +0.03%) |

| Sensex Friday Close | 83,274–83,432 range |

| VIX Level | Nine‑month low – low volatility |

| Institutional Activity FIIs sold | ~Rs 760 cr; DIIs ~Rs 1,028 cr on July 4 |

| US Tariff Deadline July 9 | Uncertainty remains |

| Key Support / Resistance | 25,200–25,300 support; 25,700–26,000 resistance |

Summary: Sensex Nifty 7 July 2025 Price

India’s markets started flat today, in wait‑and‑watch mode ahead of the US tariff deadline.

Technical support lies between 25,200–25,300; resistance sits near 26,000.

Bajaj Finance and Marico are shining; Trent lags. Jane Street ban weighs on sentiment.

Analysts say July 10 could be a game‑changer.

Strategy: buy dips carefully, keep track of trade news, and follow high‑potential stocks.

[…] Also Read – Flat Start Of Sensex & Nifty on 7 July 2025. […]